Effects of Inflation on ROI The Carter Company uses the ROI criterion to evaluate the performance of

Question:

Effects of Inflation on ROI The Carter Company uses the ROI criterion to evaluate the performance of its divisions.

The company prides itself on the formal capital-budgeting procedures it uses for approving new investments and the subsequent control procedures it has implemented to measure the performance of those new investments. Recently, however, the ROI measure.has been producing performance statistics quite at variance with the criterion used to screen the investments. The company believes that recent high inflation rates may be contributing to the erratic performance evaluation measures. The problem is well illustrated by comparing the performance of two divisions.

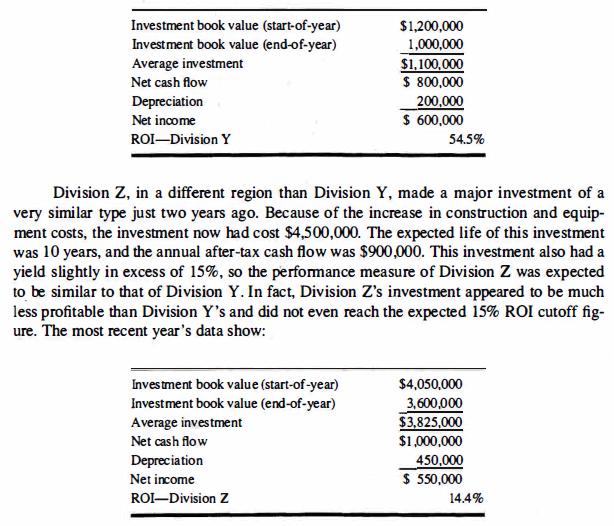

Division Y made a major investment 10 years ago. This investment cost $3,000,000 and had an expected life of 15 years and annual after-tax cash flows of $52????,000. The rate of return of slightly more than 15% was above the Carter Company's cost of capital. During the past 10 years, the price level had risen by 67%, and the after-tax cash flows from the investment had increased to an annual level of $800,000. The ROI for Division Y for the most recent year was computed as:

The price index was 120 10 years ago when Division Y's investment was made.

Two years ago, when Division Z made its investment, the index was 180, and in the most recent year, for which the above data were prepared, the index averaged 200.

Required Analyze this situation explaining why two divisions with such similar investments (15%

after-tax returns from the discounted cash flow analysis) are showing such disparate ROis.

Step by Step Answer:

Advanced Management Accounting

ISBN: 9780132622882

3rd Edition

Authors: Robert S. Kaplan, Anthony A. Atkinson, Kaplan And Atkinson