Effect of Depreciation on ROI Computations The Streetorn Corporation is contemplating the purchase of a new piece

Question:

Effect of Depreciation on ROI Computations The Streetorn Corporation is contemplating the purchase of a new piece of equipment.

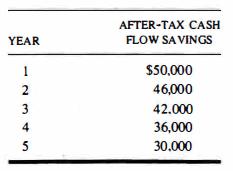

The equipment has an expected life of five years and is expected to produce the following after-tax cash flow savings for the following five years:

The asset will cost $138,300 and thus has an after-tax yield of 16%, which is above the company's after-tax cost of capital of 15%. The declining pattern of annual cash flow savings is caused by higher maintenance costs as the equipment ages, as well as the reduction in tax benefits from use of the sum-of-years-digits (SYD) method for depreciation.

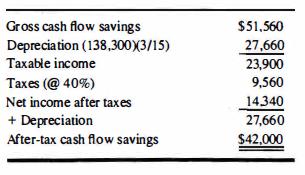

For example, the gross cash flow savings in year 3 (before depreciation and before taxes) is $5 1 ,560. The net after-tax cash flow savings is obtained by the following computation:

(Optional Assignment: Compute the gross cash flow savings for years 1-5.)

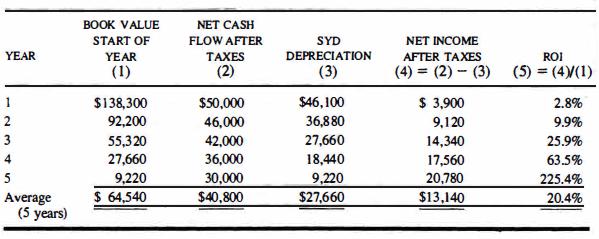

The president's bonus is based on the company'--s return-on-investment (net income after taxes/investment at start of year). The company prides itself on its conservative accounting policies and therefore uses the same depreciation method for financial reporting as it does for its tax return. The controller of Streetorn has prepared the following table to show the president the annual ROI from the new piece of equipment:

The president is astonished by this table. He says, "Something's very wrong here.

According to your cash-flow analysis, this piece of equipment has a 16% after-tax yield.

Yet our financial statements show a different yield each year, and the low RO???? in the first two years is going to keep me out of bonus money. Sure the equipment shows a fantastic ROI in its last two years, but I may not be with the company by then. I need results right away, not four years from now!"

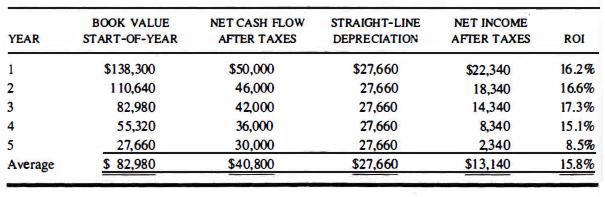

The controller decides that the trouble may be with the firm's conservative accounting practices. Perhaps if the firm used straight-line depreciation for financial reporting, as do most of the other firms in the industry, the numbers would look better. He proceeds to produce the following table:

The president is much happier with this presentation, especially since now the asset shows good returns in the earlier years. But he is still puzzled as to why an asset with a yield of 16% does not show a 16% ROI each year.

Required ( 1) Verify that this piece of equipment does have a 16% yield.

(2) Show, using the present-value depreciation method, how the equipment can have a 16%

ROI for each of the five years of the asset's life.

(3) Why did the ROI using the straight-line depreciation method approximate the actual yield reasonably well (for at least the first four years of the asset's life)?

Step by Step Answer:

Advanced Management Accounting

ISBN: 9780132622882

3rd Edition

Authors: Robert S. Kaplan, Anthony A. Atkinson, Kaplan And Atkinson