Enormous Engineering (EE) plc is a large multidivisional engineering company having interests in a wide variety of

Question:

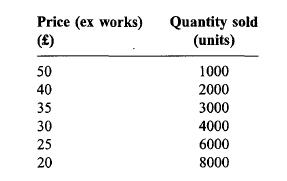

Enormous Engineering (EE) plc is a large multidivisional engineering company having interests in a wide variety of product markets. The Industrial Products Division (IPD) sells component parts to consumer appliance manufacturers, both inside and outside the company. One such part, a motor unit, it sells solely to external customers, but buys the motor itself internally from the Electric Motor Division. The Electric Motor Division (EMD) makes the motor to IPD specifications and it does not expect to be able to sell it to any other customers. In preparing the 2001 budgets IPD estimated the number of motor units it expects to be able to sell at various prices as follows:

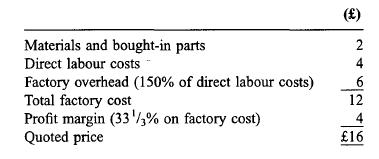

It then sought a quotation from EMD, who offered to supply the motors at 16 each based on the following estimate:

Factory overhead costs are fixed. All other costs are variable. Although it considered the price quoted to be on the high side, IPD nevertheless believed that it could still sell the completed unit at a profit because it incurred costs of only 4 (material 1 and direct labour 3) on each unit made. It therefore placed an order for the coming year. On reviewing the budget for 2001 the finance director of EE noted that the projected sales of the motor unit were considerably less than those for the previous year, which was disappointing as both divisions concerned were working well below their capacities. On- making enquiries he was told by IPD that the price reduction required to sell more units would reduce rather than increase profit and that the main problem was the high price charged by EMD. EMD stated that they required the high price in order to meet their target profit margin for the year, and that any reduction would erode their pricing policy. You are required to: (a) develop tabulations for each division, and for the company as a whole, that indicate the anticipated effect of IPD selling the motor unit at each of the prices listed, (10 marks) (b) (i) show the selling price which IPD should select in order to maximize its own divisional profit on the motor unit, (2 marks)

(ii) show the selling price which would be in the best interest of EE as a whole, (iii) explain why this latter price is not selected by IPD, (c) state: (2 marks) (1 mark) (i) what changes you would advise making to the transfer pricing system so that it will motivate divisional managers to make better decisions in future, (5 marks) (ii) what transfer price will ensure overall optimality in this situation. (5 marks)

Step by Step Answer: