IPL Limited uses a small casting in one of its finished products. The castings are purchased from

Question:

IPL Limited uses a small casting in one of its finished products. The castings are purchased from a foundry. IPL Limited purchases 54,000 castings per year at a cost of ₹800 per casting.

The castings are used evenly throughout the year in the production process on a 360-day-per-year basis. The company estimates that it costs ₹9,000 to place a single purchase order and about ₹300 to carry one casting in inventory for a year. The high carrying costs result from the need to keep the castings in carefully controlled temperature and humidity conditions, and from the high cost of insurance.

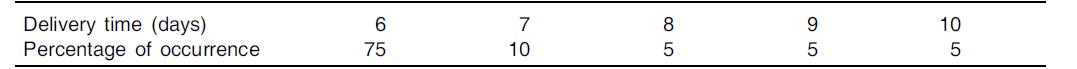

Delivery from the foundry generally takes 6 days, but it can take as much as 10 days. The days of delivery time and percentage of their occurrence are shown in the following tabulation:

Required: (i) Compute the economic order quantity (EOQ). (ii) Assume the company is willing to assume a 15 per cent risk of being out of stock. What would be the safety stock? The re-order point? (iii)

Assume the company is willing to assume a 5 per cent risk of being out of stock. What would be the safety stock? The re-order point? (iv) Assume 5 per cent stock-out risk. What would be the total cost of ordering and carrying inventory for one year? (v) Refer to the original data. Assume that using process re-engineering the company reduces its cost of placing a purchase order to only ₹600. In addition, the company estimates that when the waste and inefficiency caused by inventories are considered, the true cost of carrying a unit in stock is ₹720 per year.

(a) Compute the new EOQ.

(b) How frequently would the company be placing an order, as compared to the old purchasing policy?

Step by Step Answer:

Management Accounting Text Problems And Cases

ISBN: 9781259026683

6th Edition

Authors: M Y Khan, P K Jain