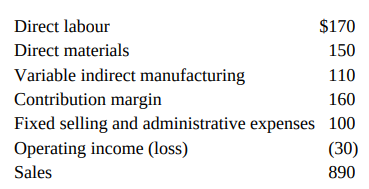

Jackson Company had the following data (in thousands) for a given period. Assume there are no inventories.

Question:

Jackson Company had the following data (in thousands) for a given period. Assume there are no inventories.

Compute (a) the variable manufacturing cost of goods sold, (b) the variable selling and administrative expenses, and (c) the fixed indirect manufacturing costs.

Transcribed Image Text:

Direct labour $170 Direct materials 150 Variable indirect manufacturing Contribution margin Fixed selling and administrative expenses 100 110 160 Operating income (loss) (30) Sales 890

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 63% (11 reviews)

The data are placed in the format of the income statement a...View the full answer

Answered By

Hassan Imtiaz

The following are details of my Professional Experience. Responsibilities Eight years of demanding teaching experience in the field of finance and business studies at Master’s Level. Completion of the given tasks within given time with quality and efficiency. Marketing professional with practical experience in and solid understanding of a diverse range of management applications, including market analysis, sales and marketing, team building and quality assurance. I have excellent skills to approach deal and sustain corporate clients / customers by demonstrating not only extraordinary communication and interpersonal skills but also high caliber presentation, negotiation and closing skills. Manage and follow up the day-to-day activities. Manage and co-ordinate the inventories. Fulfillment of all the tasks assigned.

The following are details of my Areas of Effectiveness. Finance 1. Corporate Finance 2. Advanced Corporate Finance 3. Management of Financial Institutions 4. International Financial Management 5. Investments 6. Fixed Income 7. Real Estate Investment 8. Entrepreneurial Finance 9. Derivatives 10. Alternative Investments 11. Portfolio Management 12. Financial Statement Analysis And Reporting (US GAAP & IFRS) 13. International Financial Markets 14. Public Finance 15. Personal finance 16. Real estate 17. Financial Planning Quantitative Analysis 1. Time Value Of Money 2. Statistics 3. Probability Distribution 4. Business Statistics 5. Statistical Theory and Methods Economics 1. Principles of Economics 2. Economic Theory 3. Microeconomic Principles 4. Macroeconomic Principles 5. International Monetary Economics 6. Money and Banking 7. Financial Economics 8. Population Economics 9. Behavioral Economics International Business 1. Ethics 2. Business Ethics 3. An introduction to business studies 4. Organization & Management 5. Legal Environment of Business 6. Information Systems in Organizations 7. Operations Management 8. Global Business Policies 9. Industrial Organization 10. Business Strategy 11. Information Management and Technology 12. Company Structure and Organizational Management Accounting & Auditing 1. Financial Accounting 2. Managerial Accounting 3. Accounting for strategy implementation 4. Financial accounting 5. Introduction to bookkeeping and accounting Marketing 1. Marketing Management 2. Professional Development Strategies 3. Business Communications 4. Business planning 5. Commerce & Technology Human resource management 1. General Management 2. Conflict management 3. Leadership 4. Organizational Leadership 5. Supply Chain Management 6. Law 7. Corporate Strategy Creative Writing 1. Analytical Reading & Writing Other Expertise 1. Risk Management 2. Entrepreneurship 3. Management science 4. Organizational behavior 5. Project management 6. Financial Analysis, Research & Companies Valuation 7. And any kind of Excel Queries

4.80+

150+ Reviews

230+ Question Solved

Related Book For

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu

Question Posted:

Students also viewed these Business questions

-

Jackson Company had the following income statement amounts for the year ended December 31, 2007: Sales.........................................................$4,624,274 Cash dividends...

-

Spadoni Company had the following data (in thousands) for a given period. Assume there are no inventories. Direct labor .............. $165 Direct materials ........... 160 Variable indirect...

-

The Kerwin Company had the following data (in thousands) for a given period: Sales ............. $780 Direct materials ......... 180 Direct labor ............ 230 Indirect manufacturing costs .......

-

Slip Systems had no short-term investments prior to 2015. It had the following transactions involving short-term investments in available-for-sale securities during 2015. Feb. 6 Purchased 3,400...

-

Make a figure analogous to Fig. 21.4 for an ideal inductor in an ac circuit. Start by assuming that the voltage across an ideal inductor is vL (t) = VL sin w t. Make a graph showing one cycle of vL...

-

Problems 107116. The purpose of these problems is to keep the material fresh in your mind so that you are better prepared for later sections, a final exam, or subsequent courses such as calculus....

-

Describe how to account for a forward contract that is intended as a hedge of an identifiable foreign currency commitment. AppendixLO1

-

Consider Tractors, Inc.'s performance management system in light of what we have discussed as an ideal system and how a company can ensure that its system is legally sound. As the new human resources...

-

8 5 your bullish on Alphabet Inc. (GOOG). The current price of Alphabet Inc is $1,000 and a call option expiring in one year on this stock with an exercise price of $1,000(X) is selling for $100(C)...

-

Lost Dutchman Mines, Inc., is considering investing in Peru. It makes a bid to the government to participate in the development of a mine, the profits of which will be realized at the end of five...

-

Stein Jewellery had the following data (in thousands of South African rands, ZAR) for a given period. Assume there are no inventories. Fill in the blanks. Sales ZAR 370 Direct materials Direct labour...

-

Athletic Supply (VAS) makes game jerseys for athletic teams. The F.C. Oak Bay soccer club has offered to buy 100 jerseys for the teams in its league for $15 per jersey. The team price for such...

-

How can investors go about valuing the market?

-

Determine the magnitude of the magnetic flux through the south-facing window of a house in British Columbia, where Earth's B field has a magnitude of 5.8 x 10-5T and the direction of B field is 72...

-

A wedge with an inclination of angle rests next to a wall. A block of mass m is sliding down the plane, as shown. There is no friction between the wedge and the block or between the wedge and the...

-

Conner Leonard worked for Purges Manufacturing for 32 years. Along with four other men, he helped to start the company that designed and built products sold around the world. Purges Manufacturing...

-

Reconsider the collision between two objects diagrammed below where two objects move on a frictionless surface. Before collision After collision Experiment 1 A, 1 B A B Draw complete and properly...

-

3. Now the bomb arrives. Please catch fx,y(x, y) = = cx cx - dy, where 0 < x < 1, 0 y x. 13 a) Please find coefficients c, d such that cd= 8 b) Please find fx(x) and fy (y). Are X and Y independent?...

-

Perform an analysis of the network of Fig. 2.156b using PSpice Windows Fig. 2.156b Ip - 5 V Si + 8 V 1.2 k2 2.2 k2 4.7 k2 Si 6 -6 V (a) (b)

-

Accounting policies and practices that are most important to the portrayal of the companys financial condition and results, and require managements most difficult, subjective, or complex judgments...

-

Describe the flow of costs from raw materials to cost of goods sold in a manufacturing organization.

-

How do the cost flows in a retail organization or service organization differ from those in a manufacturing organization?

-

Compare the defining characteristic and cost behavior of a consumable (flexible) resource to those of a capacity-related resource.

-

4 Exercise 9-6 (Algo) Lower of cost or market [LO9-1) 75 Tatum Company has four products in its inventory. Information about the December 31, 2021, Inventory is as follows: oints Product Total Cost...

-

A real estate investment is expected to return to its owner $3,500 per year for 16 years after expenses. At the end of year 16, the property is expected to be sold for $49,000. Assuming the required...

-

You borrowed $15,000 for buying a new car from a bank at an interest rate of 12% compounded monthly. This loan will be repaid in 48 equal monthly installments over four years. Immediately after the...

Study smarter with the SolutionInn App