Manchester Machining Company (MMC) produces and sells three main product lines. The company employs a standard cost-accounting

Question:

Manchester Machining Company (MMC) produces and sells three main product lines. The company employs a standard cost-accounting system for recordkeeping purposes.

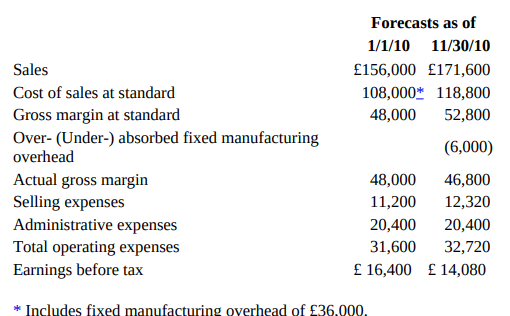

At the beginning of 2010, the president of MMC presented the budget to the parent company and accepted a commitment to earn a profit of £16,400 in 2010. The president has been confident that the year’s profit would exceed the budget target, since the monthly sales reports that he has been receiving have shown that sales for the year will exceed budget by 10 percent. The president is both disturbed and confused when the controller presents an adjusted forecast as of November 30, 2010, indicating that profit will be 14 percent under budget.

Manchester Machining Company Forecasts of Operating Results

There have been no sales price changes or product-mix shifts since the 1/1/10 forecast. The only cost variance on the income statement is the underabsorbed manufacturing overhead. This arose because the company produced only 16,000 standard machine-hours (budgeted machine-hours were 20,000) during 2010 as a result of a shortage of raw materials while its principal supplier was closed by a strike. Fortunately, MMC’s finished-goods inventory was large enough to fill all sales orders received.

Required

1. Analyze and explain why the profit has declined in spite of increased sales and good control over costs. Show computations.

2. What plan, if any, could MMC adopt during December to improve its reported profit at year-end? Explain your answer.

3. Illustrate and explain how MMC could adopt an alternative internal cost-reporting procedure that would avoid the confusing effect of the present procedure. Show the revised forecasts under your alternative.

4. Would the alternative procedure described in requirement 3 be acceptable to MMC for financial-reporting purposes? Explain.

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu