Maxim Auto Parts Ltd. has operated three automobile parts manufacturing plants in Ontario for many years. Two

Question:

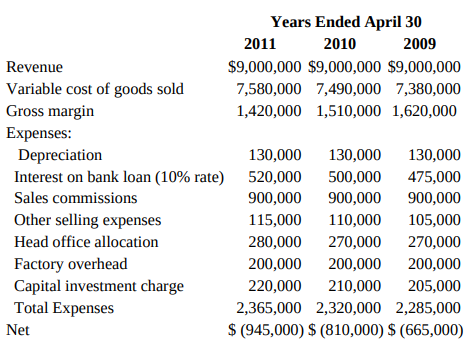

Maxim Auto Parts Ltd. has operated three automobile parts manufacturing plants in Ontario for many years. Two produce engine parts, and the third makes seats (“the seat division”). In recent years, the seat division’s plant has been operating well below capacity as a result of the loss of a major contract. The operating results of the seat division for the past three years are as follows:

All revenue is from one sales contract with a large automobile manufacturer. Depreciation is calculated on a straight-line basis on each of the division’s assets: building, machinery and equipment, and vehicles. Interest is based on a $5.2 million bank loan made directly to the seat division. Sales commissions are based on revenue and are payable to the agent who negotiated the sales contract several years ago. Other selling expenses consist primarily of transportation expenses (approximately 1 percent of revenue) plus other non-transportation costs to service the automobile manufacturer’s needs. The head office allocation is a charge for the use of the head office staff and is based on relative sales revenue of the three divisions. Factory overhead is for nonvariable costs of manufacturing the seats. The capital investment charge is for imputed interest on the current replacement cost of the division’s land, building, inventories, and other assets (net of divisional debt).

The seat division has received an offer to lease its land and building for five years at $1,000,000 per annum, receivable at the beginning of each year with an agreement to sell the building and land at the end of the five years for $5,000,000. The prospective lessee has agreed to pay for all operating expenses of the building, such as property taxes, insurance, heating, and water. If Maxim does not enter into the lease and sale agreement, the net realizable value of the land is expected to increase at least enough to offset any decline in the value of the building over the next five years.

The machinery and equipment has a replacement cost of $3 million. Management estimates that it could be sold now for about $500,000. The machinery and equipment will be worth only about $100,000 in scrap value in another five years.

Seat-division management has determined that another auto parts manufacturer would be willing to produce the seats for the five years that remain on the contract with the automobile manufacturer. The contract cannot be cancelled without incurring heavy penalties. The seat division is required to manufacture exactly 100,000 seats. The other manufacturer will charge $95 per seat for the entire five-year period, and will deliver them at no cost to Maxim.

If the seat division is closed, sales commissions would still have to be paid by Maxim, as would $150,000 of head office allocation that is currently being charged to the seat division. In addition, 25 percent of the “factory overhead” would still have to be paid if the seat division were closed or if the land and building were leased. The nontransportation portion

No other long-term liabilities exist in the seat division, other than the bank loan at 10 percent interest per annum. You have been requested by Maxim’s management to prepare a report on the course of action they should follow. Management wants you to include in your report the analysis supporting your recommendations.

Required

Write the report requested by Maxim’s management. (Ignore income taxes and the time value of money.)

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu