One of three projects of a company is doing poorly and is being considered for replacement. The

Question:

One of three projects of a company is doing poorly and is being considered for replacement.

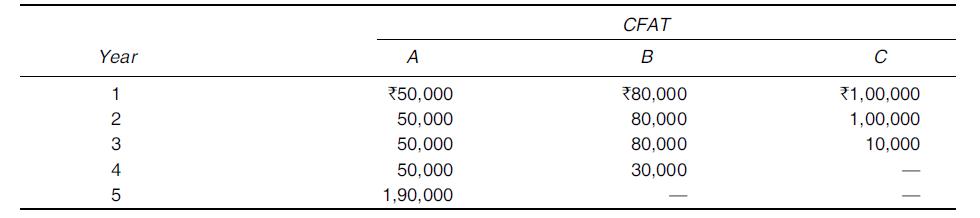

The projects are expected to require ₹2,00,000 each, have an estimated life of 5 years, 4 years, and 3 years respectively, and have no salvage value. The required rate of return is 10 percent. The anticipated cash flows after taxes (CFAT) for the three projects are as follows:

(i) Rank each project applying the methods of payback, average rate of return, net present value, and internal rate of return.

(ii) Recommend the project to be adopted and give reasons.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Management Accounting Text Problems And Cases

ISBN: 9781259026683

6th Edition

Authors: M Y Khan, P K Jain

Question Posted: