Owners of a catering company also own a number of relatively small coffee shops, one of which

Question:

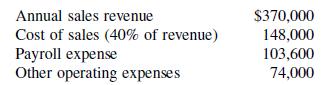

Owners of a catering company also own a number of relatively small coffee shops, one of which shows excellent potential to increase its sales revenue. Selected annual operating figures are

Based on the potential of increasing revenue, the owners are seriously considering a 10-year lease on an adjoining property, which requires a full 10-year upfront payment of $96,000. New equipment at a cost of $20,000 would have to be purchased. The equipment is estimated to have a 10-year life and no residual value. An additional investment in food inventory of $1,500 would be required.

Revenue is estimated to increase by 20 percent above the present level, and the cost of sales is expected to remain at the current cost of sales percentage. Payroll costs are expected to increase by $160 per week and other costs by $150 per week. A minimum 15 percent pretax investment return is wanted by the owners.

1. Should the investment be made?

2. As an alternative, the owners are considering borrowing $60,000 of the required investment at a 10 percent interest rate. Would the decision change if debt financing were obtained rather than the owners using their funds?

Step by Step Answer:

Hospitality Management Accounting

ISBN: 9780471092223

8th Edition

Authors: Martin G Jagels, Michael M Coltman