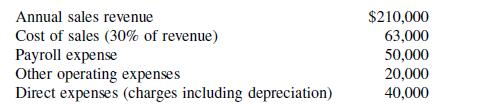

The owners of a cocktail bar have the following annual income statement information: The owners are considering

Question:

The owners of a cocktail bar have the following annual income statement information:

The owners are considering new furnishings for the bar at an estimated cost of $20,000 using their own funds. They anticipate the new furnishings will bring in additional customers, and their revenue will increase by 10 percent above their current level. The new furnishings are estimated to have a five-year life with no residual value. The new furnishings will be depreciated using straight-line depreciation.

To provide service to the additional customers, more staff would be hired at an additional cost of $125 per week. Other operating costs will increase by $1,400 per year. There will be no increase to direct (fixed)

charges other than depreciation expense. The income tax rate will remain at 25 percent. The owners will go ahead with the project only if the return on their $20,000 investment is 15 percent per year or more in the first year.

a. Should they make the $20,000 investment in new furnishings?

b. If they had the alternative of using only $10,000 of their own funds and borrowing the other $10,000 at 10 percent interest, would the decision change?

Step by Step Answer:

Hospitality Management Accounting

ISBN: 9780471092223

8th Edition

Authors: Martin G Jagels, Michael M Coltman