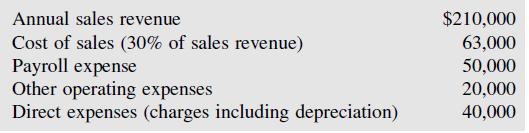

The owners of a cocktail bar have the following annual income statement information: The owners are considering

Question:

The owners of a cocktail bar have the following annual income statement information:

The owners are considering new furnishings for the bar at an estimated cost of $20,000 using their own funds. They anticipate the new furnishings will bring in additional customers, and their sales revenue will increase by 10% above their current level. The new furnishings are estimated to have a five-year life with no residual value. The new furnishings will be depreciated using straight-line depreciation.

To provide service to the additional customers, more staff would be hired at an additional cost of $125 per week. Other operating costs will increase by $1,400 per year. There will be no increase to direct (fixed) charges other than depreciation expense. The income tax rate will remain at 25%. The owners will go ahead with the project only if the return on their $20,000 investment is 15% per year or more in the first year.

a. Should they make the $20,000 investment in new furnishings?

b. If they had the alternative of using only $10,000 of their own funds and borrowing the other $10,000 at 10% interest, would the decision change?LO1

Step by Step Answer:

Hospitality Management Accounting

ISBN: 9780471687894

9th Edition

Authors: Martin G Jagels, Catherine E Ralston