Portfolio selection and capital rationing Fronzak Ltd serves two related markets and is budgeting its capital expenditures

Question:

Portfolio selection and capital rationing Fronzak Ltd serves two related markets and is budgeting its capital expenditures for next year.

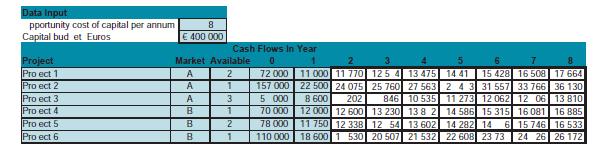

Each of Fronzak’s three department heads contributed two investment projects anonymously to the capital budgeting committee (CBC) for final selection decisions. The CBC has gathered information about the annual investment conditions and constraints. The firm’s opportunity cost of capital is 8% per annum, and its annual capital budget is €400000. Details about the six proposed investment projects are shown below.

Required:

1. Compute the net present values of the six investment projects.

2. Use Excel’s Solver to select the optimal portfolio of available projects. Only whole projects may be purchased.

3. Fronzak’s CBC required anonymous contribution of capital projects because the committee wanted to review the projects objectively. What might be gained, what might be lost by this policy? What would you recommend?

Step by Step Answer: