Spot Ltd. produces three products, X, Y and Z in three production departments: Moulding (Dept. M), Assembly

Question:

Spot Ltd. produces three products, X, Y and Z in three production departments:

Moulding (Dept. M), Assembly (Dept. A) and Finishing (Dept. F). It also has two service departments responsible for repairs and maintenance (Dept. R) and for development and research (Dept. D).

Employees in Dept. R are paid total salaries of £24,000 per annum and complete timesheets to account for their time. Departments M, A, F and D utilise its services in the ratio 70:20:8:2 respectively.

Dept. D studies improvements in working practices and product designs. The salary costs of this department total £20,000 per annum, and its work is expected to benefit the three production departments equally.

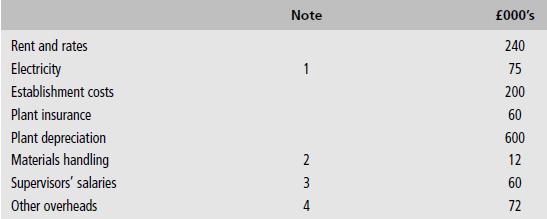

The management accountant has estimated that the following factory overheads

(excluding the salaries described above) will be incurred in the coming year:

Notes

1. Electricity costs are split equally between heating and lighting (50%) and power for production machines (50%).

2. Materials requisitions during the year are expected to average 20 per day for Dept. M, 15 per day for Dept. A, and 2 per day for each of Departments F and R.

3. There are two supervisors who cover the whole of the production and service operations of the country. It is estimated that a production employee requires three times the supervision of a service employee.

4. Other overheads are incurred 90% on production and 10% on servicing. The individual production and service departments are treated as equally responsible for their share of such costs.

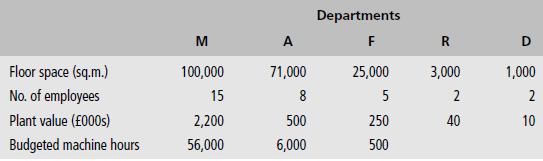

The following information is relevant to the company and its departments:

The budgeted production details for the coming year are expected to be as follows:

(a) Given that Dept. M is machine-intensive and Departments A and F are labour-intensive, calculate the total absorption cost per unit for each of the company’s three products using the most reasonable overhead absorption rates.

(b) The managing director has heard that using overhead absorption rates based on estimated figures can result in the under- or over-recovery of overheads. Write a brief memorandum to the managing director explaining the advantages of using estimated OARs, the situations in which under- or over-recovery of overheads may occur and the accounting treatment of such items.

Step by Step Answer:

Management Accounting Principles And Applications

ISBN: 9781412908436

1st Edition

Authors: Hugh Coombs, D Ellis Jenkins, David Hobbs