The Argent Company, which makes and seIls a single product, is preparing a budget for the next

Question:

The Argent Company, which makes and seIls a single product, is preparing a budget for the next three months. Because of possible seasonal fluctuations in sales, the company normally keeps finished stock at a level equal to 150% of the budgeted unit sales for the following month.

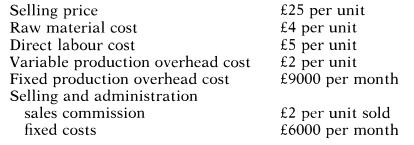

The budgeted costs and selling price for the product are as follows:

The factory can normally produce up to 2000 units per month, but it is possible to increase production by 25% by leasing an extra machine at a cost of f2000 per month and working overtime, which is paid at double the normal rate. The fixed production overheads include a depreciation charge on existing machinery. This machinery cost f240000 new, and is being depreciated on a straight-li ne basis over its expected 5-year life. Finished goods stock is valued on an absorption cost basis, using the weighted average method. At the end of July 1988, finished stock was expected to amount to 2500 units valued at 05 300.

Raw material is paid for 1 month after delivery and sufficient is kept in stock to cover one month's budgeted production. The finished goods are sold on credit with 20% of debts being collected in the month of sale. 78% in the following month, and the remaining 2% being bad debts. All other costs are paid for in the month they are incurred, except for sales commission which is paid in the following month.

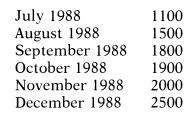

Expected unit sales for July 1988 and the following five months are:

The managing director realizes that substantial overtime may be needed in November 1988 to meet the December demand and is concerned that this may lead to hidden costs or other adverse effects on the business.

Required:

1. Prepare a budgeted profit and loss account, with supporting schedules, for the period 1 August to 31 October 1988..

2. Calculate the budgeted cash flow for the same period and reconcile the net cash flow and profit figures for the quarter.

3. Write a short report to the managing director outlining the likely impact on profit and the business generally from the level of overtime working expected. Suggest alternative operating strategies which would reduce the level of overtime working and improve business performance.

NB: Make all calculations to the nearest pound.

From: ICAEW, PEll, Managing Accounting, July 1988.

Step by Step Answer: