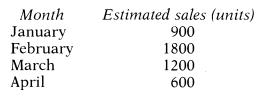

A small company producing a single product estimates that it will seIl the following amounts of its

Question:

A small company producing a single product estimates that it will seIl the following amounts of its product in the next few months:

It wishes to construct a profit budget for the first 3 months of the new year and has made the following estimates:

(a) The product will seIl at an ex-factory price of El2 per unit.

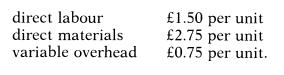

(b) Variable production costs comprise:

(c) Fixed costs are:

The production fixed costs include 0000 per month depreciation on machinery and other fixed assets.

(d) The finished goods inventory at the end of December amounts to 200 units, valued at HO each. Finished goods inventory is valued on an average actual-cost basis.

Required:

(a) Compute, the budgeted profit for January, February and March, presenting your workings in the form of a neat schedule.

(b) Compute the net cash flow for March, assuming that 40% of debtors pay after I month and the remainder after 2 months, and that all other cash costs are paid by the end of each month.

(c) Prepare a brief report for management explaining the differences in budgeted profit each month, and also the difference between the March cash flow and profit figures.

Would you have preferred to have valued inventory on a different basis?

Step by Step Answer: