The Bailriggers Division specializes in manufacturing rigging for sailing dinghies and smaIl yachts - a growth industry.

Question:

The Bailriggers Division specializes in manufacturing rigging for sailing dinghies and smaIl yachts - a growth industry. But the firm also has a sideline in wire products for garden use, including Twisteze, a high-quality, plastic coated wire supplied in small drums for various uses in domestic gardens. Twisteze is sold through garden shops at f4.50 recommended retail price, the normal trade discount being 32%. The company is currently producing and selling 252000 drums per year of Twisteze, which represents 70% of annual capacity.

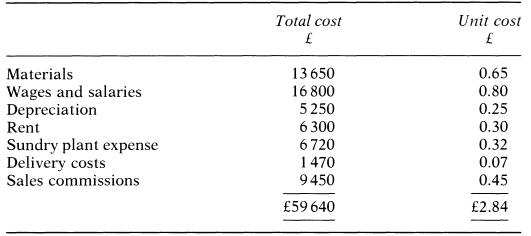

Factory accounts show the following monthly costs for average output:

A chain store offers to buy on contract a quantity of Twisteze that may average 4000 drums per month at f1.75 per drum. The chain store would reseIl the drums under their own brand name: costs of colouring and substitute labelling of the drums are insignificant and may be ignored. Sales to the chain store would give rise to no sales commission or delivery costs (the customer would collect in his own transport). Inquiry elicits that wages are directly variable with output up to 22000 units per month, but rise to 1.00 per unit there after. Capacity per month is limited to one-twelfth annual capacity there is no slack labour or machinery transferable in the short run from other products. 60% of the material costs concern wire transferred in from another division of the firm at aprice yielding 40% contribution to that division. Sundry plant expense is 25% fixed.

Required:

(a) present are port calculating the probable advantage or otherwise of accepting the chain store order. Clearly explain the assumptions on which your calculation is based.

(b) re-appraise your decision above in the light of new information concerning the 40% of materials not transferred in from the other division. The histori call book cost of this material to satisfy one month's pro due ti on of the order is 1040. It can be sold now for 1500, less 10% selling costs. Alternatively, it can be converted at a cost of f1000 into material used for sailing dinghies whose present replacement cost is 3100.

(c) Using your analysis in (a) and (b), above, how will the accounting information for decision making differ from that used for control purposes?

(d) What are the implication's of your analysis for achieving behaviour congruence?

Step by Step Answer: