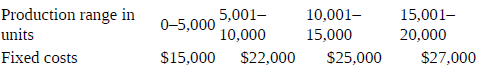

The Disposable Camera Division of Saari Optics Co. has the following cost-behaviour patterns: Maximum production capacity is

Question:

The Disposable Camera Division of Saari Optics Co. has the following cost-behaviour patterns:

Maximum production capacity is 20,000 units per year. Variable costs per unit are $5 at all production levels. Each situation described below is to be considered independently.

1. Production and sales are expected to be 11,000 units for the year. The sales price is $7 per unit. How many additional units need to be sold, in an unrelated market, at $6 per unit to show a total overall net income of $900 per year?

2. The company has orders for 23,000 units at $7. If it wanted to make a minimum overall net income of $14,500 on these 23,000 units, what unit purchase price would it be willing to pay a subcontractor for 3,000 units? Assume that the subcontractor would act as Saari’s agent, deliver the units to customers directly, and bear all related costs of manufacture, delivery, and so on. The customers, however, would pay Saari directly as goods were delivered.

3. Production is currently expected to be 7,000 units for the year at a selling price of $7. By how much may advertising or special promotion costs be increased to bring production up to 14,500 units and still earn a total net income of 2 percent of dollar sales?

4. Net income is currently $12,500. Non-variable costs are $25,000. However, competitive pressures are mounting. A 5 percent decrease in price will not affect sales volume but will decrease net income by $4,750. What is the present volume, in units? Refer to the original data.

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu