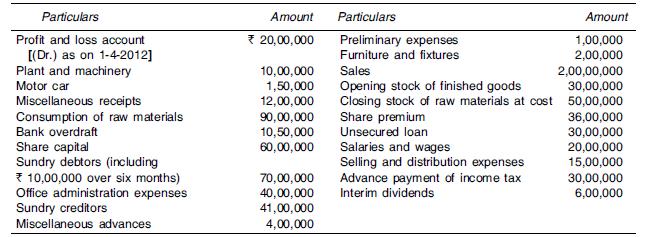

The following balances have been extracted from the books of X Ltd as on March 31, 2013:

Question:

The following balances have been extracted from the books of X Ltd as on March 31, 2013:

Additional Information:

(i) Closing stock of finished goods at cost is ₹60,00,000.

(ii) The original cost of fixed assets was: Plant and machinery ₹20,00,000; Furniture and fixtures ₹3,00,000; and Motor car ₹2,50,000.

Depreciation is to be charged on the written down value (a) 10 per cent on plant and machinery and furniture and fixtures; and 20 per cent on motor car. There were no additions or disposals during the year.

(iii) The entire authorised capital which consists of equity shares of ₹100 each has been issued and subscribed. The share capital is paid up to the extent of 30 per cent and there are no calls-in-arrears.

(iv) Provision for taxation ₹35,00,000.

(v) Preliminary expenses are to be written off.

(vi) Office administration expenses include auditors fee: ₹50,000 and director’s fees ₹30,000.

(vii) The unsecured loan was taken on January 1, 2013 @ 18 per cent p.a. Interest is payable half yearly and necessary provisions are to be made in accounts.

(viii) The directors have proposed a final dividend of ₹6 on each equity share in addition to the interim dividend already declared.

You are required to prepare profit and loss account for the year ended March 31, 2013 and the balance sheet as on that date. You may ignore Company Law requirements in this regard.

Step by Step Answer:

Management Accounting Text Problems And Cases

ISBN: 9781259026683

6th Edition

Authors: M Y Khan, P K Jain