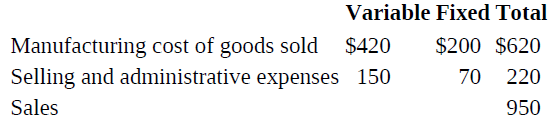

The following data have been condensed from Chateau Corporations report of 2012 operations (in $000s): 1. Prepare

Question:

The following data have been condensed from Chateau Corporation’s report of 2012 operations (in $000’s):

1. Prepare the 2012 income statement in contribution form, ignoring income taxes.

2. Chateau’s operations have been fairly stable from year to year. In planning for the future, top management is considering several options for changing the annual pattern of operations. You are asked to perform an analysis of their estimated effects. Use your contribution income statement as a framework to compute the estimated operating income (in 000’s) under each of the following separate and unrelated assumptions:

a. Assume that a 10 percent reduction in selling prices would cause a 30 percent increase in the physical volume of goods manufactured and sold.

b. Assume that an annual expenditure of $30,000 for a special sales promotion campaign would enable the company to increase its physical volume by 10 percent with no change in selling prices.

c. Assume that a basic redesign of manufacturing operations would increase annual fixed manufacturing costs by $80,000 and decrease variable manufacturing costs by 15 percent per product unit, but with no effect on physical volume or selling prices.

d. Assume that a basic redesign of selling and administrative operations would double the annual fixed expenses for selling and administration and increase the variable selling and administrative expenses by 25 percent per product unit, but would also increase physical volume by 20 percent. Selling prices would be increased by 5 percent.

e. Would you prefer to use the absorption form of income statement for the above analyses? Explain.

3. Discuss the desirability of alternatives (a) through (d) in requirement 2. If only one alternative could be selected, which would you choose?

Explain.

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu