Tsumagari Company, an electronics company in Kobe, Japan, is planning to buy new equipment to produce a

Question:

Tsumagari Company, an electronics company

in Kobe, Japan, is planning to buy new equipment to produce a new product.

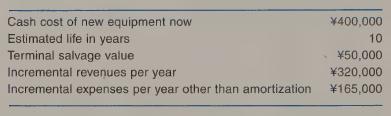

Estimated data (monetary amounts are in thousands of Japanese yen) are:

Assume a 60 percent flat rate for income taxes. All revenues and expenses

other than amortization will be received or paid in cash. Use a 14 percent discount

rate. Assume a ten-year straight-line amortization for tax purposes. Also

assume that the terminal salvage value will affect the amortization per year.

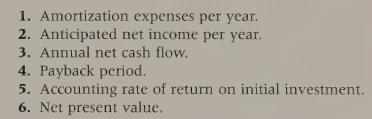

Compute

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Management Accounting

ISBN: 9780367506896

5th Canadian Edition

Authors: Charles T Horngren, Gary L Sundem, William O Stratton, Howard D Teall, George Gekas

Question Posted: