When planning operations for the year, Southbrook Company chose a denominator activity of 40,000 direct labour-hours. According

Question:

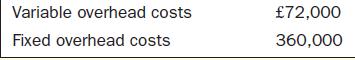

When planning operations for the year, Southbrook Company chose a denominator activity of 40,000 direct labour-hours. According to the company’s flexible budget, the following manufacturing overhead costs should be incurred at this activity level:

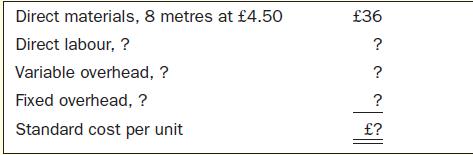

The company produces a single product that requires 2.5 hours to complete. The direct labour rate is £6 per hour. Eight metres of material are needed to complete one unit of product; the material has a standard cost of £4.50 per metre. Overhead is applied to production on the basis of direct labour-hours.

Required

1. Compute the predetermined overhead rate. Break the rate down into variable and fixed cost elements.

2. Prepare a standard cost card for one unit of product using the following format:

3. Prepare a graph with cost on the vertical (y) axis and direct labour-hours on the horizontal (x) axis. Plot a line on your graph from a zero level of activity to 60,000 direct labour-hours for each of the following costs:

(a) Budgeted fixed overhead (in total).

(b) Applied fixed overhead (applied at the hourly rate computed in Requirement 1 above).

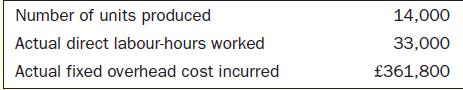

4. Assume that during the year actual activity is as follows:

(a) Compute the fixed overhead budget and volume variances for the year.

(b) Show the volume variance on the graph you prepared in Requirement 3 above.

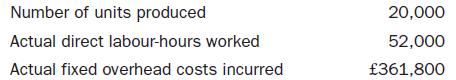

5. Disregard the data in Requirement 4 above. Assume instead that actual activity during the year is as follows:

(a) Compute the fixed overhead budget and volume variances for the year.

(b) Show the volume variance on the graph you prepared in Requirement 3 above.

Step by Step Answer:

Management Accounting

ISBN: 9780077185534

6th Edition

Authors: Will Seal, Carsten Rohde, Ray Garrison, Eric Noreen