The U.S. MNC Pax Americana Inc. is concerned by the anticipated impact of the Spanish peseta (Pta)

Question:

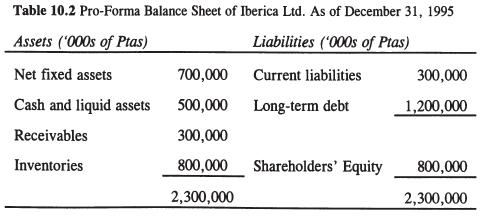

The U.S. MNC Pax Americana Inc. is concerned by the anticipated impact of the Spanish peseta (Pta) devaluation upon its net consolidated earnings as well as on the net worth of its Spanish affiliate Iberica Ltd. According to Iberica's pro-forma balance sheet for December 31, 1995 (table 10.2), Iberica's assets and liabilities in thousands of pesetas (Ptas) are listed below. On January 2, 1996, the prevailing spot exchange rate is SPta,$(O) = 121.34.

(a) Measure the translation exposure in Pta terms that will be outstanding by December 31, 1995. Assume that all accounts, except for fixed net assets, are exposed accounts.

(b) Assuming that the management of Pax Americana is risk-averse, show how a contractual hedging strategy will reduce potential translation loss to the currently prevailing 12 % annual forward discount on the Spanish Pta per unit of Pta exposure.

(c) An alternative approach is for Iberica Ltd. to borrow Spanish Ptas and convert them immediately to U.S. dollars. Explain how the latter approach effectively eliminates Pax Americana's exposure in I dollars return 7 112 % annually on the Eurodollar market? Which approach would you select? Compare the two methods graphically.

Step by Step Answer:

Management And Control Of Foreign Exchange Risk

ISBN: 978-0792380887

1st Edition

Authors: Laurent L. Jacque