M is the holding company of a number of companies within the engineering sector. One of these

Question:

M is the holding company of a number of companies within the engineering sector. One of these subsidiaries is PQR which specialises in building machines for manufacturing companies. PQR uses absorption costing as the basis of its routine accounting system for profit reporting.

PQR is currently operating at 90% of its available capacity, and has been invited by an external manufacturing company, to tender for the manufacture of a bespoke machine. It PQR’s tender is accepted by the manufacturing company then it is likely that another company within the M group will be able to obtain work in the future servicing the machine. As a result, the Board of Directors of M are keen to win the tender for the machine and are prepared to accept a price from the manufacturing company that is based on the relevant costs of building the machine.

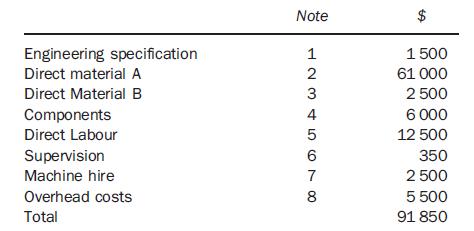

An engineer from PQR has already met with the manufacturing company to determine the specification of the machine and he has worked with a non-qualified accountant from PQR to determine the following cost estimate for the machine.

Notes

1 The engineer that would be in charge of the project to build the machine has already met with the manufacturing company, and subsequently prepared the specification for the machine. This has taken three days of his time and his salary and related costs are \($500\) per day. The meeting with the manufacturing company only took place because of this potential work; no other matters were discussed at the meeting.

2 The machine would require 10 000 square metres of Material A.

This material is regularly used by PQR. There is currently 15 000 square metres in inventory, 10 000 square metres were bought for \($6\) per square metre and the remainder were bought for \($6.30\) per square metre. PQR uses the weighted average basis to value its inventory. The current market price of Material A is \($7\) per square metre, and the inventory could be sold for \($6.50\) per square metre.

3 The machine would also require 250 metre lengths of Material B. This is not a material that is regularly used by PQR and it would have to be purchased specifically for this work. The current market price is \($10\) per metre length, but the sole supplier of this material has a minimum order size of 300 metre lengths. POR does not foresee any future use of any unused lengths of Material B, and expects that the net revenue from its sale would be negligible.

4 The machine would require 500 components. The components could be produced by HK, another company within the M group.

The direct costs to HK of producing each component is \($8,\) and normal transfer pricing policy within the M group is to add a 50%

mark up to the direct cost to determine the transfer price. HK has unused capacity which would allow them to produce 350 components, but thereafter any more components could only be produced by reducing the volume of other components that are currently sold to the external market. These other components, although different, require the same machine time per unit as those required by PQR, have a direct cost of \($6\) per component and currently are sold for \($9\) each.

Alternatively PQR can buy the components from the external market for \($14\) each.

5 The machine will require 1000 hours of skilled labour. The current market rate for engineers with the appropriate skills is \($15\) per hour. PQR currently employs engineers that have the necessary skills at a cost of \($12.50\) per hour, but they do not have any spare capacity. They could be transferred from their existing duties if temporary replacements were to be engaged at a cost of \($14\) per hour.

6 The project would be supervised by a senior engineer who currently works 150 hours per month and is paid an annual salary of \($42\) 000. The project is expected to take a total of one month to complete, and if it goes ahead is likely to take up 10%

of the supervisor’s time during that month. If necessary the supervisor will work overtime which is unpaid.

7 It will be necessary to hire specialist machine for part of the project. In total the project will require the machine for 5 days but it is difficult to predict exactly which five days the machine will be required within the overall project time of one month. One option is to hire the machine for the entire month at a cost of \($5\) 000 and then sub-hire the machine for \($150\) per day when it is not required by PQR. PQR expects that it would be able to subhire the machine for 20 days. Alternatively PQR could hire the machine on the days it requires and its availability would be guaranteed at a cost of \($500\) per day.

8 PQR’s fixed production overhead cost budget for the year totals \($200\) 000 and is absorbed into its project costs using a skilled direct labour hour absorption rate, based on normal operating capacity of 80% PQR’s capacity budget for the year is a total of 50 000 skilled direct labour hours. PQR’s latest annual forecast is for overhead costs to total \($220\) 000, and for capacity to be as originally budgeted.

Required:

(a) You are employed as assistant Management Accountant of the M group. For each of the resource items identified you are to:

(i) discuss the basis of the valuation provided for each item (ii) discuss whether or not you agree with the valuation provided in the context of the proposed tender (iii) prepare a revised schedule of relevant costs for the tender document on behalf of the M group.

(b) Assume that PQR successfully wins the bid to build the machine for a selling price of \($100\) 000 and that the costs incurred are as expected. Discuss the conflict that will arise between the profit expected from the project by the Board of M on a relevant cost basis and the project profit that will be reported to them by PQR using its routine accounting practices. Use at least two specific examples from the bid to explain the conflict that you discuss.

(c) Discuss two non-financial matters that you consider relevant to this decision.

Step by Step Answer: