Activity-based job costing, unit cost comparisons. (30 mins) Aircomposystemes, SA, has a machining facility specialising in work

Question:

Activity-based job costing, unit cost comparisons. (30 mins)

Aircomposystemes, SA, has a machining facility specialising in work for the aircraft components market. The prior job-costing system had two direct-cost categories (direct materials and direct manufacturing labour)

and a single indirect-cost pool (manufacturing overhead, allocated using direct labour-hours). The indirect cost-allocation rate of the prior system for 2000 would have been SFr 115 per direct manufacturing labour-hour.

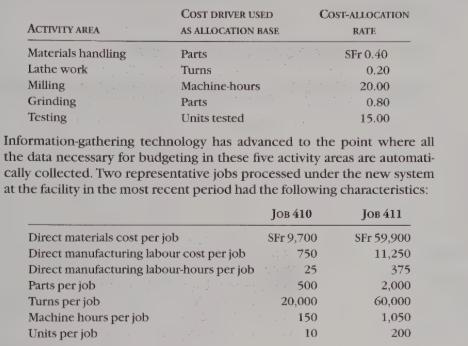

Recently, a team with members from product design, manufacturing and accounting used an activity-based approach to refine its job-costing system. The two direct-cost categories were retained. The team decided to replace the single indirect-cost pool with five indirect-cost pools. These five cost pools represent five activity areas at the facility, each with its Own supervisor and budget responsibility. Pertinent data are as follows: bhyt45

1. Calculate the per unit manufacturing costs of each job under the prior jobcosting system.

2. Calculate the per unit manufacturing costs of each job under the activitybased job-costing system.

3. Compare the per unit cost figures for Jobs 410 and 411 calculated in requirements 1 and 2. Why do the prior and the activity-based costing systems differ in their job cost estimates for each job? Why might these differences be important to Aircomposystemes?

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster