Advan ced : Adjusting cash flows for inflation Bailey Ltd is developing a new product, the Oakman

Question:

Advan ced : Adjusting cash flows for inflation Bailey Ltd is developing a new product, the Oakman , to replace an established product. the Shepard, which the company has marketed successfully for a number of years. Production of the Shepard will cease in one year whether or not the Oakman is manufactured. Bailey Ud has recently spent £75000 on research and development relating to the Oakman . Production of the Oakman can start in one year's time.

Demand for the Oakman is expected to be 5000 units per annum for the first three years of production and 2500 units per annum for the subsequent two years . The product's total life Is expected to be five years .

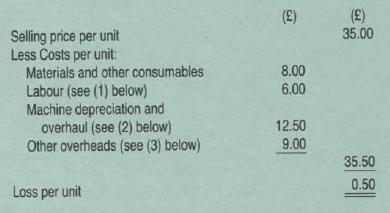

Estimated unit revenues and costs for the Oakman , at current prices. are as follows:

(1) Each Oakman requires two hours of labour, paid £3 per hour at current prices . The labour force required to produce Oakmans comprises six employees, who are at present employed to produce Shepards. If the Oakman is not produced, these employees will be made redundant when production of the Shepard ceases. If the Oakman IS produced, three of the employees will be made redundant at the end of the third year of its life, when demand havles, but the company expects to be able to find work for the remaining three employees at the end of the Oakman 's five-year life. Any employee who is made redundant will receive a redundancy payment equivalent to 1000 hours'

wages, based on the most recent wage rate at the time of the redundancy (2) A special machme will be required to produce the Oakman.

It will be purchased in one year's time oust before production begins). The current price of the machine is £190000. It is expected to last for five years and to have no scrap or resale value at the end of that time. A major overhaul of the machine will be necessary at the end of the second year of its life. At current prices, the overhaul will cost £60 000 . As the machine will not produce the same quantity of Oakmans each year. the directors of Bailey ltd have decided to spread its original cost and the cost of the overhaul equally between all Oakmans expected to be produced (i.e. 20 000 units). Hence the combined charge per unit for depreciation and overhaul is £12.50 ((£190000 + £60000] ~ 20000 units) .

(3) Other overheads at current prices comprise variable overheads of £4.00 per unit and head office fixed costs of £5.00 per unit, allotted on the basis of labour time.

All wage rates are expected to increase at an annual compound rate of 15% . Selling price per unit and all costs other than labour are expected to increase in line with the Retail Price Index. The Retail Price Index is expected to increase in the future at an annual compound rate of 10%.

Corporation tax at 52% on net cash income is payable in full one year after the income arises. A 100% first year tax allowance 1s available on the machine. Bailey ltd has a money cost of captal , net of corporation tax, of 20% per annum.

Assume that all receipts and payments will arise on the last day of the year to which they relate. Assume also that all 'current prices'

given above have been operative for one year and are due to change shortly. Subsequently all prices will change annually.

Your are required to:

(a) prepare calculations , with explanations, showing whether Bailey Ltd should undertake production of the Oakman :

(20 marks)

(b) discuss the particular Investment appraisal problems created by the existence of high rates of inflation.

Step by Step Answer: