Advanced : Adjusting cash flows for inflation and the calculation of NPV and ROI The general manager

Question:

Advanced : Adjusting cash flows for inflation and the calculation of NPV and ROI The general manager of the nationalized postal service of a small country, Zedland, wishes to introduce a new service. This serv1ce would offer same-day delivery of letters and parcels posted before 10 am within a distance of 150 kilometres. The service would require 100 new vans costing $8000 each and 20 trucks costing $18000 each. 180 new workers would be employed at an average annual wage of $13 000 and five managers at average annual salaries of $20 000 would be moved from their existing duties, where they would not be replaced.

Two postal rates are proposed. In the first year of operation letters will cost $0.525 and parcels $5.25. Market research undertaken at a cost of $50 000 forecasts that demand will average 15 000 letters per working day and 500 parcels per working day during the first year, and 20000 letters per day and 750 parcels per day thereafter. There is a five day working week. Annual running and maintenance costs on similar new vans and trucks are currently estimated in the first year of operation to be $2000 per van and $4000 per truck respectively. These costs will increase by 20%

per year (excluding the effects of inflation). Vehicles are depreciated over a five year period on a straight-line basis.

Depreciation is tax allowable and the vehicles will have negligible scrap value at the end of five years. Advertising in year one will cost $500 000 and in year two $250 000. There will be no advertising after year two. Existing premises will be used for the new service but additional costs of $150 000 per year will be incurred.

All the above cost data are current estimates and exclude any inflation effects. Wage and salary costs and all other costs are expected to rise because of inflation by approximately 5% per year during the five year planning horizon of the postal service. The government of Zedland will not permit annual price increases within nationalized industries to exceed the level of inflation.

Nationalized industries are normally required by the government to earn at least an annual after tax return of 5% on average investment and to achieve, on average, at least zero net present value on their investments.

The new service would be financed half with internally generated funds and half by borrowing on the capital market at an interest rate of 12% per year. The opportunity cost of capital for the postal service is estimated to be 14% per year. Corporate taxes in Zedland, to which the postal service is subject. are at the rate of 30% for annual profits of up to $500 000 and 40% for the balance in excess of $500000. Tax is payable one year in arrears. All transactions may be assumed to be on a cash basis and to occur at the end of the year with the exception of the initial investment which would be required almost immediately.

Required:

(a) Acting as an independent consultant prepare a report advising whether the new postal service should be introduced. Include in your report a discussion of other factors that might need to be taken into account before a final decision was made with respect to the introduction of the new postal service.

State clearly any assumptions that you make.

(18 marks)

{b) Monte Carlo simulation has been suggested as a possible method of estimating the net present value of a project.

Briefly assess the advantages and disadvantages of using this technique in investment appraisal.

1++ Advanced: Relevant cash flows and risk adjusted discount rates Sparrow Ltd is a construction company based in the south west of England. Mr and Mrs Hawk each own 50% of the company's issued share capital. The company's latest accounts show a balance sheet value for share capital and reserves of £250 000 and an annual turnover of £1.25 million.

The company has recently been offered two contracts, both of which would commence on 1 January 1985 and last for two years.

Neither contract can be delayed. The prices offered are £700 000 for contract 1 and £680 000 for contract 2, payable in each case on 31 December 1986. The skilled labour force of Sparrow is committed during the coming year to the extent that sufficient skilled labour will be availble to support only one of the two contracts. Due to a shortage in the area, the company will not be able to expand its skilled labour force in the foreseeable future. If necessary, Sparrow could subcontract one entire contract, but not both, to a nearby company, Kestrel Ltd, which is of a similar size to Sparrow. If one contract were subcontracted, all work would be undertaken by Kestrel subject to regular checks of progress and quality by Mr Hawk. Kestrel has quoted prices of £490000 for contract 1 and £530 000 for contract 2, payable in either case by two equal instalments on 1 January 1985 and 1 January 1986.

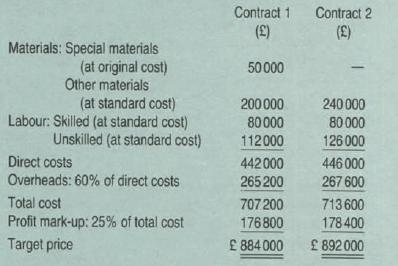

Sparrow maintains a standard costing system and normally prices contracts on a cost-plus basis. Total cost is calculated by adding to direct costs 60% for overheads, this percentage being based on previous experience. A target price is then calculated by adding a 25% profit mark-up to total cost. Mrs Hawk has calculated the following target prices for the two contracts under consideration:

The following additional information is available:

Materials: Contract 1 would require the immediate use of special materials which were purchased one year ago at a cost of £50 000 for a contract which was not completed because the customer went into liquidation. These special materials have a current purchase price of £60000 and a current realisable value of £30000. The company foresees no alternative use for these special materials.

Usage of the other materials would be spread evenly between the two years of each contract's duration. These other materials are all used regularly by the company. Their standard costs reflect current purchase prices which are expected to continue at the present level until31 December 1985 On 1 January 1986, the prices are expected to increase by 10%.

Labour: Skilled labour costs for each contract represent 8000 hours each year for two years at a standard cost of £5 per hour.

Unskilled labour hours required are 16000 hours per annum for contract 1 and 18 000 hours per annum for contract 2, in each case at a standard cost of £3.50 per hour. Standard costs are based on current wage rates. Hourly wage costs for both skilled and unskilled labour are expected to increase by 5% on 1 January 1985 and by a further 1 0% on 1 January 1986.

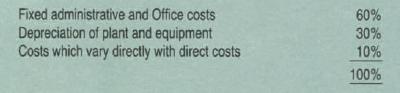

Overheads: An analysis of the most recent accounts of Sparrow shows that total overheads may be categorized as follows:

Fixed administrative and office costs are expected to increase as a resulrof inflation by 5% on 1 January 1985 and by a further 10%

on 1 January 1986.

Sparrow expects to have sufficient surplus plant and equipment capacity during the next two years for e~her contract 1 or contract 2.

Sparrow has a money cost of capital of 10% per annum. Mr Hawk expects this to increase to 15% per annum as from 1 January 1986.

Assume that all payments will arise on the last day of the year to which they relate, except where otherwise stated.

You are required to:

(a) provide calculations, on the basis of the estimates given, showing whether Sparrow should accept either or both contracts and which one, if any, should be subcontracted to Kestrel; (15 marks)

(b) discuss the problems facing small unlisted companies in the evaluation of risk in investment apppraisal, illustrating your answer by reference to the contracts which have been offered to Sparrow.

Step by Step Answer: