Advanced: Accounting disposition of variances (a) Mingus Ltd produces granoids. It revises its cost standards annually in

Question:

Advanced: Accounting disposition of variances

(a) Mingus Ltd produces granoids. It revises its cost standards annually in September for the year commencing 1 December.

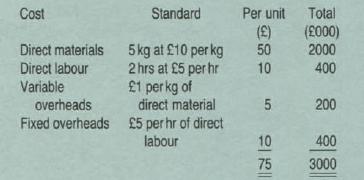

At a normal annual volume of output of 40 000 granoids its standard costs, including overheads, for the year to 30 November 1981 were:

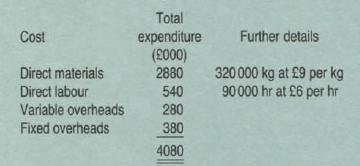

The actual expenditure incurred in that year to produce an actual output of 50000 granoids was:

Due to an industrial dispute in 1980 there was no stockholding of materials, work in progress, or completed granoids at 1 December 1980. At 30 November 1981 there was an inventory of 10 000 completed granoids, but no work in progress, and no raw materials inventory.

You are required to calculate in each case the balance which would remain in the finished goods inventory account if each of the following six costing systems were used:

(i) actual absorption costing.

(ii) standard absorption costing with variances written off, (iii) standard absorption costing with variances prorated between cost of sales and inventory, (iv) actual direct costing,

(v) standard direct costing with variances written off, (vi) standard direct costing with variances pro-rated between cost of sales and inventory. (1 o marks)

(b) You are required to comment briefly in general terms on the main effects of applying to inventory valuation the various costing systems set out above, referring to your calculations in part

(a) if you wish. (5 marks)

(c) Overhead cost absorption may be used in connection with various other matters.

You are required to discuss the use of overhead cost absorption procedures for either (i) pricing, or (ii) control of costs.

Step by Step Answer: