Advanced: Calculation and comparison of ROI and RI using straight line and annuity depreciation Alpha division of

Question:

Advanced: Calculation and comparison of ROI and RI using straight line and annuity depreciation Alpha division of a retailing group has five years remaining on a lease for premises in which it sells self-assembly furniture. Management are consider¬ ing the investment of £600000 on immediate improvements to the interior of the premises in order to stimulate sales by creating a more effective selling environment.

The following information is available:

(i) The expected increased sales revenue follow¬ ing the improvements is £500 000 per annum. The average contribution: sales ratio is expected to be 40%.

(ii) The cost of capital is 16% and the division has a target return on capital employed of 20%, using the net book value of the investment at the beginning of the year in its calculation.

(iii)At the end of the five year period the premises improvements will have a nil residual value.

Required:

(a) Prepare two summary statements for the proposal for years 1 to 5, showing residual income and return on capital employed for each year. Statement 1 should incorporate straight-line depreciation. Statement 2 should incorporate annuity depreciation at 16%.

(12 marks)

(b) Management staff turnover at Alpha division is high. The division’s investment decisions and management performance measurement are currently based on the figures for the first year of a proposal.

(i) Comment on the use of the figures from statements 1 and 2 in

(a) above as decision-making and management performance measures.

(ii) Calculate the net present value (NPV) of the premises improvement proposal and comment on its compatibility with resi¬ dual income as a decision-making measure for the proposal’s acceptance or rejection. (8 marks)

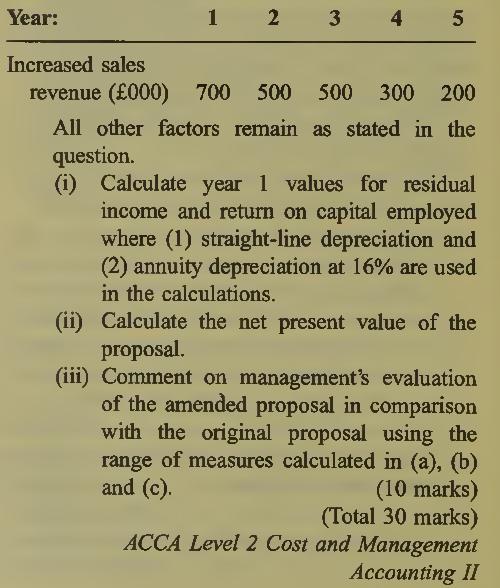

(c) An alternative forecast of the increase in sales revenue per annum from the premises im¬ provement proposal is as follows:

Step by Step Answer: