Advanced: Calculation of costs before and after introduction of a quality management programme Calton Ltd make and

Question:

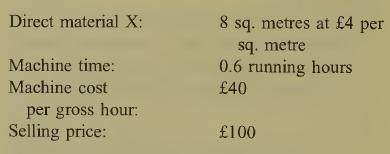

Advanced: Calculation of costs before and after introduction of a quality management programme Calton Ltd make and sell a single product. The existing product unit specifications are as follows:

Calton Ltd require to fulfil orders for 5000 product units per period. There are no stocks of product units at the beginning or end of the period under review. The stock level of material X remains unchanged throughout the period.

The following additional information affects the costs and revenues:

1. 5% of incoming material from suppliers is scrapped, due to poor receipt and storage organization.

2. 4% of material X input to the machine process is wasted due to processing problems.

3. Inspection and storage of material X costs £0.10 pence per sq. metre purchased.

4. Inspection during the production cycle, cali¬ bration checks on inspection equipment, vendor rating and other checks cost £25 000 per period.

5. Production quantity is increased to allow ifor the downgrading of 12.5% of product units at the final inspection stage. Downgraded units are sold as ‘second quality’ units at a discount of 30% on the standard selling price.

6.Production quantity is increased to allow for returns from customers which are replaced free of charge. Returns are due to specification failure and account for 5% of units initially delivered to customers. Replacement units incur a delivery cost of £8 per unit. 80% of the returns from customers are rectified using 0.2 hours of machine running time per unit and are re-sold as ‘third quality’ products at a discount of 50% on the standard selling price. The remaining returned units are sold as scrap for £5 per unit.

7. Product liability and other claims by cus¬ tomers is estimated at 3% of sales revenue from standard product sales.

8. Machine idle time is 20% of gross machine hours used (i.e. running hours = 80% of gross hours).

9. Sundry costs of administration, selling and distribution total £60 000 per period.

10.Calton Ltd is aware of the problem of excess costs and currently spends £20 000 per period in efforts to prevent a number of such prob¬ lems from occurring.

Calton Ltd is planning a quality management programme which will increase its excess cost prevention expenditure from £20000 to £60000 per period. It is estimated that this will have the following impact:

1. A reduction in stores losses of material X to 3% of incoming material.

2. A reduction in the downgrading of product units at inspection to 7.5% of units inspected.

3. A reduction in material X losses in process to 2.5% of input to the machine process.

4. A reduction in returns of products from customers to 2.5% of units delivered.

5. A reduction in machine idle time to 12.5% of gross hours used.

6. A reduction in product liability and other claims to 1% of sales revenue from standard product sales.

7. A reduction in inspection, calibration, vendor rating and other checks by 40% of the existing figure.

8. A reduction in sundry administration, selling and distribution costs by 10% of the existing figure.

9. A reduction in machine running time required per product unit to 0.5 hours.

Required:

(a) Prepare summaries showing the calculation of (i) total production units (pre-inspection), (ii) purchases of material X (sq. metres), (iii) gross machine hours. In each case the figures are required for the situation both before and after the implementation of the additional quality management programme, in order that the orders for 5000 product units may be fulfilled. (10 marks)

(b) Prepare profit and loss accounts for Calton Ltd for the period showing the profit earned both before and after the implementation of the additional quality management pro¬ gramme. (10 marks)

(c) Comment on the relevance of a quality management programme and explain the meaning of the terms internal failure costs, external failure costs, appraisal costs and prevention costs giving examples for each, taken where possible from the information in the question. (10 marks)

(Total 30 marks) ACCA Level 2 Cost and Management Accounting II

Step by Step Answer: