Advanced: Calculation of expected net present value plus a discussion of whether expected values is an appropriate

Question:

Advanced: Calculation of expected net present value plus a discussion of whether expected values is an appropriate way of evaluating risk Galuppi pic is considering whether to scrap some highly specialized old plant or to refurbish it for the production of drive mechanisms, sales of which will last for only three years. Scrapping the plant will yield £25 000 immediately, whereas refurbish¬ ment will require an immediate outlay of £375 000.

Each drive mechanism will sell for £50 and, if manufactured entirely by Galuppi pic, give a contribution at current prices of £10. All internal company costs and selling prices are predicted to increase from the start of each year by 5%. Refurb¬ ishment of the plant will also entail fixed costs of £10000, £12 500 and £15 000 for the first, second and third years respectively.

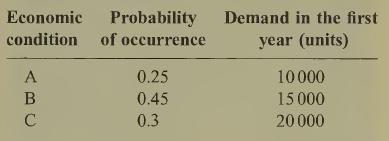

Estimates of product demand depend on differ¬ ent economic conditions. Three have been identi¬ fied as follows:

Demand in subsequent years is expected to increase at 20% per annum, regardless of the initial level demanded.

The plant can produce up to 20000 drive mechanisms per year, but Galuppi pic can supply more by contracting to buy partially completed mechanisms from an overseas supplier at a fixed price of £20 per unit. To convert a partially completed mechanism into the finished product requires additional work amounting, at current prices, to £25 per unit. For a variety of reasons the supplier is only willing to negotiate contracts in batches of 2000 units.

All contracts to purchase the partially completed units must be signed one year in advance, and payment made by Galuppi pic at the start of the year in which they are to be used.

Galuppi pic has a cost ofcapital of15%perannum, and you may assume that all cash flows arise at the end ofthe year, unless you are told otherwise.

Requirements:

(a) Determine whether refurbishment ofthe plant is worthwhile.

(b) Discuss whether the expected value method is an appropriate way of evaluating the different risks inherent in the refurbishment decision of Galuppi pic.

Step by Step Answer: