Advanced: Calculation of IRR and incremental yield involving identification of relevant cash flows LF Ltd wishes to

Question:

Advanced: Calculation of IRR and incremental yield involving identification of relevant cash flows LF Ltd wishes to manufacture a new product. The company is evaluating two mutually exclusive machines, the Redo and the Bunger. Each machine is expected to have a working life of four years, and is capable of a maximum annual output of 150000 units.

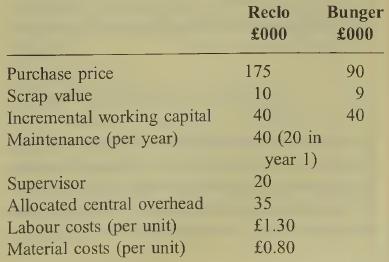

Cost estimates associated with the two machines include:

The Redo requires 120 square metres of operating space. LF Ltd currently pays £35 per square metre to rent a factory which has adequate spare space for the new product. There is no alternative use for this spare space. £5000 has been spent on a feasibility survey of the Redo.

The marketing department will charge a fee of £75 000 per year for promoting the product, which will be incorporated into existing plans for catal¬ ogues and advertising. Two new salesmen will be employed by the marketing department solely for the new product, at a cost of £22 500 per year each. There are no other incremental marketing costs.

The selling price in year one is expected to be £3.50 per unit, with annual production and sales esti¬ mated at 130000 units throughout the four year period. Prices and costs after the first year are ex¬ pected to rise by 5% per year. Working capital will be increased by this amount from year one onwards.

Taxation is payable at 25% per year one year in arrears and a writing-down allowance of 25% per year is available on a reducing balance basis.

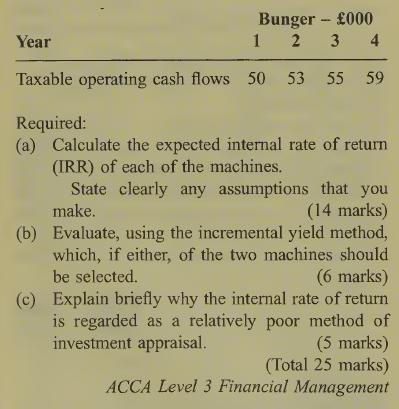

The company’s accountant has already estimated the taxable operating cash flows (sales less relevant labour costs, materials costs etc., but before taking into account any writing-down allowances) of the second machine, the Bunger. These are:

Step by Step Answer: