Advanced: Calculation of sales variances on an absorption and variable costing basis and reconciliation of actual with

Question:

Advanced: Calculation of sales variances on an absorption and variable costing basis and reconciliation of actual with budgeted margin Claylock Ltd make and sell a single product. The company operates a standard cost system and the following information is available for period 5:

(i) Standard product cost per unit: (£)

Direct material 8 kilos at £5.40 per kilo 43.20 Direct labour 2.5 hours at £4.50 per hour 11.25 Fixed production overhead 17.00 (ii) The standard selling price per unit is £90.

(iii) Direct labour hours worked total 12000 hours. Labour productivity in comparison to standard was 90%.

(iv) 42 000 kilos of direct material were purchased at £5.60 per kilo. Issues from stores to produc¬ tion totalled 36000 kilos during the period.

(v) Stocks of finished goods rose from nil to 300 units during the period. It was budgeted that all units produced would be sold during the period.

(vi) Stocks of raw materials and finished goods are valued at standard cost.

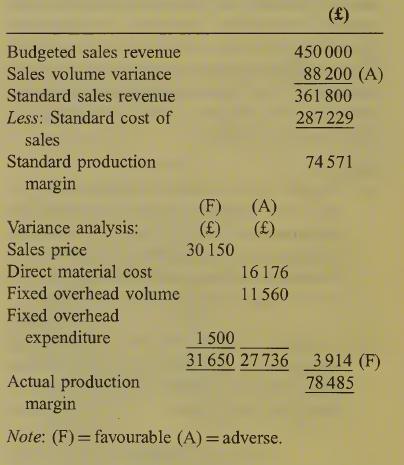

(vii) Summary operating statement for period 5:

Required:

(a) Determine the values of the sales volume variance when it is expressed alternatively in terms of: standard revenue; standard produc¬ tion margin; and standard contribution. Discuss which valuation, when combined with the sales price variance, provides a measure of whether the sales variance have resulted in a net cash benefit to the company.

(b) Analyse the direct material cost variance into relevant sub-variances and comment on the method by which material usage is valued by Claylock Ltd. (7 marks)

(c) Analyse the fixed overhead volume variance into two sub-variances and comment on the relevance of each sub-variance as perceived by adherents of absorption costing. (7 marks)

(d) Prepare an operating statement for period 5 which amends the statement given in the question into standard marginal cost format. Explain the reason for any difference in the actual production margin from that reported under the present system. Comment also on any changes in the variances reported in the amended statement. (7 marks) (Total 30 marks) ACCA Level 2 Cost and Management Accounting II

Step by Step Answer: