Advanced: Computation of ABC and traditional product costs plus a discussion of ABC Repak Ltd is a

Question:

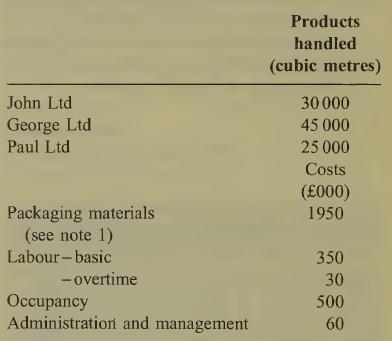

Advanced: Computation of ABC and traditional product costs plus a discussion of ABC Repak Ltd is a warehousing and distribution company which receives products from customers, stores the products and then re-packs them for distribution as required. There are three customers for whom the service is provided - John Ltd, George Ltd and Paul Ltd. The products from all three customers are similar in nature but of varying degrees of fragility. Basic budget information has been gathered for the year to 30 June and is shown in the following table:

Note 1: Packaging materials are used in re-packing each cubic metre of product for John Ltd, George Ltd and Paul Ltd in the ratio 1:2:3 respectively. This ratio is linked to the relative fragility of the goods for each customer.

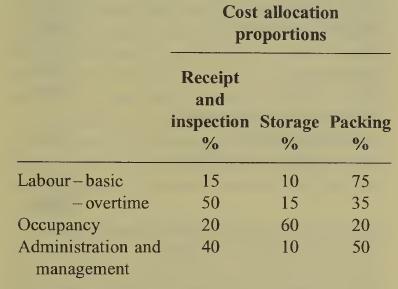

Additional information has been obtained in order to enable unit costs to be prepared for each of the three customers using an activity-based costing approach. The additional information for the year to 30 June has been estimated as follows: (i) Labour and overhead costs have been identi-fied as attributable to each of three work centres - receipt and inspection, storage and packing as follows:

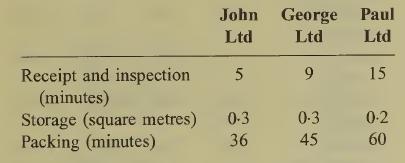

(ii) Studies have revealed that the fragility of different goods affects the receipt and inspec¬ tion time needed for the products for each customer. Storage required is related to the average size of the basic incoming product units from each customer. The re-packing of goods for distribution is related to the complexity of packaging required by each customer. The relevant requirements per cubic metre of product for each customer have been evaluated as follows:

Required:

(a) Calculate the budgeted average cost per cubic metre of packaged products for each customer for each of the following two circumstances:

(i) where only the basic budget information is to be used, (6 marks)

(ii) where the additional information enables an activity-based costing approach to be applied. (14 marks)

(b) Comment on the activities and cost drivers which have been identified as relevant for the implementation of activity-based costing by Repak Ltd and discuss ways in which activity- based costing might improve product costing and cost control in Repak Ltd. Make reference to your answer to part

(a) of the question, as appropriate.

Step by Step Answer: