Advanced: Divisional performance measurement using different methods of asset valuation plus non-financial measures (a) When a previously

Question:

Advanced: Divisional performance measurement using different methods of asset valuation plus non-financial measures

(a) When a previously centralized organisation decides to decentralize a major part of its planning and control functions to a series of independent divisional operating units, the nature of and flow of accounting and other information will require redefinition.

You are required to

(i) identify the main problems faced at the level of both central and divisional management in carrying out their planning and control functions which arise from the changes in the flow of information resulting from decentralization;

(5 marks)

(ii) explain the purposes which performance measures serve in the context of the problems identified in (i). (5 marks)

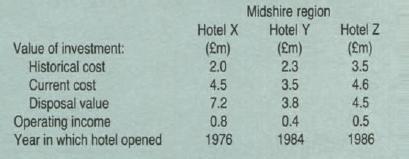

(b) The new managing director of the ABC Hotels group intends to conduct a survey of financial performance in each region of the country in which the group operates. Initially, a pilot study is to be carried out in the Midshires region.

He discovers that the available accounting information is based on historical cost, with management performance in each hotel measured as a return on investment (Rol)

However, the practice has been that the group finance director requires requests for additional investment funds to be evaluated using the discounted cash How (DCF) criterion.

The managing director has asked you. as the group's financial advisor, to see whether the existing information provides an adequate basis for the evaluation of the group's investments and its divisional performance. As part of the investigation, you have produced the following information, using the company's existing accounting information and your own estimates, relating to the year ended June 1989:

The 'investment' includes land, buildings and the hotel fixtures and fittings.

The historical cost valuation is net of accumulated depreciation.

The current cost valuation is the current cost of replacing the buildings and facilities to their present standard at current prices. It includes an indexation of the cost of land for the general increase in prices.

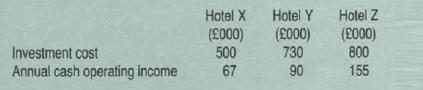

You are also informed that the group recently asked hotel managers to put forward proposals to improve and modernise their facilities.

A minimum 12% DCF rate of return was to be used to evaluate each proposal, a rate which the company's brokers affirm would be seen as a satisfactory return. Details of the proposals from the Midshire region hotels were:

You are required to advise on:

(i) the current and prospective future financial position of the Midshire region hotels; (10 marks)

(ii) additionalrnformation which may be used to supplement the general rate of return measures in the evaluation of the hotels' managements.

Step by Step Answer: