Advanced: Expected net present value and decision whether to abandon a project after one yearA company is

Question:

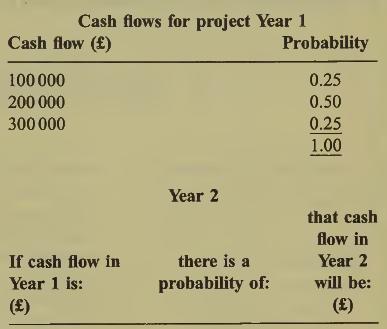

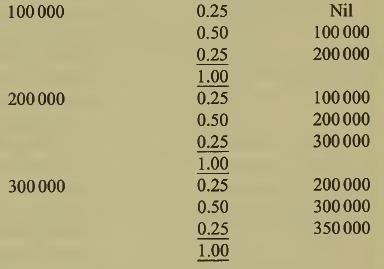

Advanced: Expected net present value and decision whether to abandon a project after one yearA company is considering a project involving the outlay of £300 000 which it estimates will generate cash flows over its 2-year life at the probabilities shown in the following table:

Note: All cash flows should be treated as being received at the end of the year.

It has a choice of undertaking this project at either of two sites (A or B) whose costs are identical and are included in the above outlay. In terms of the technology of the project itself, the location will have no effect on the outcome.

If the company chooses site B it has the facility to abandon the project at the end of the first year and to sell the site to an interested purchaser for £150000. This facility is not available at site A.

The company’s investment criterion for this type of project is 10% DCF. Its policy would be to abandon the project on site B and to sell the site at the end of year 1 if its expected future cash flows for year 2 were less than the disposal value.

You are required to:

(a) calculate the NPV of the project on site A;

(7 marks)

(b) (i) explain, based on the data given, the specific circumstances in which the company would abandon the project on site B;

(ii) calculate the NPVof the project on site B taking account of the abandonment facility; (14 marks)

(c)calculate the financial effect of the facility for abandoning the project on site B, stating whether it is positive or negative. (4 marks) Ignore tax and inflation.

Step by Step Answer: