Advanced: Inflation adjustments and sensitivity analysis (a) Burley pic, a manufacturer of building products, mainly supplies the

Question:

Advanced: Inflation adjustments and sensitivity analysis

(a) Burley pic, a manufacturer of building products, mainly supplies the wholesale trade. It has recently suffered falling demand due to economic recession, and thus has spare capacity. It now perceives an opportunity to produce designer ceramic tiles for the home improvement market. It has already paid £0.5m for development expenditure, market research and a feasibility study.

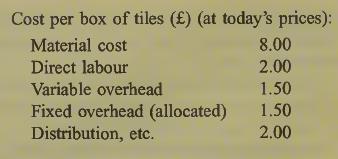

The initial analysis reveals scope for sell¬ ing 150000 boxes per annum over a five-year period at a price of £20 per box. Estimated operating costs, largely based on experience, are as follows:

Production can take place in existing facilities although initial re-design and set-up costs would be £2m after allowing for all relevant tax reliefs. Returns from the project would be taxed at 33%.

Burley’s shareholders require a nominal return of 14% per annum after tax, which includes allowance for generally-expected inflation of 5.5% per annum. It can be assumed that all operating cash flows occur at year ends.

Required:

Assess the financial desirability of this venture in real terms, finding both the Net Present Value and the Internal Rate of Return to the nearest 1%) offered by the project.

Note: Assume no tax delay. (7 marks)

(b) Briefly explain the purpose of sensitivity analysis in relation to project appraisal, indi¬ cating the drawbacks with this procedure.

(6 marks)

(c) Determine the values of (i) price (ii) volume at which the project’s NPV becomes zero. Discuss your results, suggesting appropriate management action. (7 marks)

(Total 20 marks) ACCA Paper 8 Managerial Finance

Step by Step Answer: