Advanced: Product cost calculation and costs for decision-making Kaminsky Ltd manufactures belts and braces. The firm is

Question:

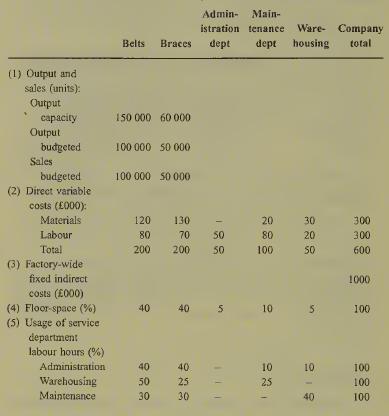

Advanced: Product cost calculation and costs for decision-making Kaminsky Ltd manufactures belts and braces. The firm is organized into five departments. These are belt-making, braces-making, and three service departments (maintenance, warehousing, and administration).

Direct costs are accumulated for each depart¬ ment. Factory-wide indirect costs (which are fixed for all production levels within the present capacity limits) are apportioned to departments on the basis of the percentage of floorspace occupied. Service department costs are apportioned on the basis of estimated usage, measured as the percentage of the labour hours operated in the service department utilized by the user department. Each service department also services at least one other service department.

Budgeted data for the forthcoming year are shown below:

(a) You are required to calculate the total cost per unit of belts and braces respectively, in accor¬ dance with the system operated by Kaminsky Ltd. (12 marks)

(b) In addition to the above data, it has been decided that the selling prices of the products are to be determined on a cost-plus basis, as the unit total cost plus 20%.

Two special orders have been received, outside the normal run of business, and not provided for in the budget.

They are as follows:

(i) an order for 1000 belts from Camfam, an international relief organization, offering to pay £5000 for them.

(ii) a contract to supply 2000 belts a week for 50 weeks to Mixon Spenders, a chainstore, at a price per belt of ‘unit total cost plus 10%’.

You are required to-set out the considerations which the management of Kaminsky Ltd should take into account in deciding whether to accept each of these orders, and to advise them as far as you are able on the basis of the information given. (8 marks)

(c) ‘Normalized overhead rates largely eliminate from inventories, from cost of goods sold, and from gross margin any unfavourable impact of having production out of balance with the long-run demand for a company’s products.’ You are required to explain and comment upon the above statement.

Step by Step Answer: