Advanced: Profitability analysis including an apportionment of joint costs and identification of relevant costs/revenues for a price/output

Question:

Advanced: Profitability analysis including an apportionment of joint costs and identification of relevant costs/revenues for a price/output decision A company manufactures two joint products in a single process.

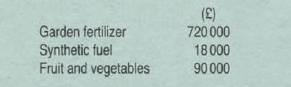

One is sold as a garden fertilizer, the other is a synthetic fuel which is sold to external customers but which can also be used to heat greenhouses in which the company grows fruit and vegetables all year round as a subsidiary market venture. Information relating to the previous 12 month period is as follows:

(i) 1 600000 kilos of garden fertilizer were produced and then sold at £3.00 per kilo. Joint costs are apportioned between the garden fertilizer and the synthetic fuel on a physical units (weight) basis. The fertilizer has a contribution to sales ratio of 40% after such apportionment. There are no direct costs of fertilizer sales or production.

(ii) The synthetic fuel represents 20% of the total weight of output from the manufacturing process. A wholesaler bought 160 000 kilos at £1.40 per kilo under a long-term contract which stipulates that its availability to him will not be reduced below 1 00 000 kilos per annum. There is no other external market for the fuel. Fixed administrative, selling and distribution costs incurred specifically as a result of the fuel sales to the wholesaler totalled £40 000. That part of the fuel production which was sold to the wholesaler, incurred additional variable costs for packaging of £1 .20 per kilo. (iii) The remaining synthetic fuel was used to heat the company greenhouses. The greenhouses produced 5 kilos of fruit and vegetables per kilo of fuel. The fruit and vegetables were sold at an average price of £0.50 per kilo. Total direct costs of fruit and vegetable production were £520000.

Direct costs included a fixed labour cost of £100 000 which is avoidable if fruit and vegetable production ceases, the remainder being variable with the quantity produced.

A notional fuel charge of £1 .40 per kilo of fuel is made to fruit and vegetable production. This notional charge is in addition to the direct costs detailed above.

(iv) Further company fixed costs were apportioned to the products as follows

The above data was used to produce a profit and loss analysis for the 12 month period for each of three areas of operation VIZ.

1. Garden fertilizer 2. Synthetic fuel (including external sales and transfers to the greenhouses at £1 .40 per kilo).

3. Fruit and vegetables (incorporating the deduction of any notional charges).

Required:

(a) Prepare a summary statement showing the profit or loss reported in each of the three areas of operation detailed above. (8 marks)

(b) Calculate the percentage reduction in the fixed costs of £40000 which would have been required before the synthetic fuel sales for the previous 12 month period would have resulted in a net benefit to the company. (3 marks)

(c) Calculate the net benefit or loss which sales of fruit and vegetables caused the company in the previous 12 month period. (3 marks)

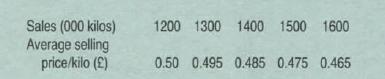

(d) Advise management on the fruit and vegetable price strategy for the coming year if fruit and vegetable production/sales could be expanded according to the following pricefdemand pattern:

All other costs, prices and quantities will remain unchanged during the coming year. The wholesaler will continue to purchase all available synthetic fuel not used in the greenhouses.

Step by Step Answer: