Advanced: Joint cost stock valuation and decision-making Milo pic has a number of chemical processing plants 1n

Question:

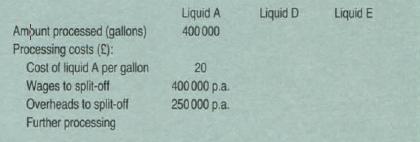

Advanced: Joint cost stock valuation and decision-making Milo pic has a number of chemical processing plants 1n the UK At one of these plants it takes an annual input of 400 000 gallons of raw material A and converts it into two liquid products, B and C.

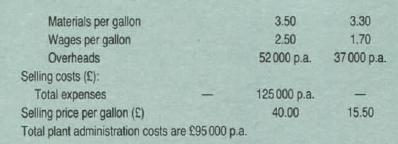

The standard yield from one gallon of material A is 0.65 gallons of 8 and 0.3 gallons of C. Product B is processed further, without volume loss, and then sold as product D. Product C has hitherto been sold without further processing. In the year ended 31 July 1984, the cost of material A was £20 per gallon. The selling price of product C was £5 per gallon and transport costs from plant to customer were £7 4 000.

Negotiations are taking place with Takeup Ltd who would purc~ase the total production of product C for the years ending 31 July 1985 and 1986 provided it was converted to product E by further processing. It is unlikely that the contract would be renewed after 31 July 1986. New specialized transport costing £120000 and special vats costing £80000 will have to be acquired if the contract is to be undertaken. The vats will be installed in part of the existing factory that is presently unused and for which no use has been forecast for the next three years. Both transport and vats will have no residual value at the end of the contract. The company uses straight line depreciation Projected data for 1985 and 1986 are as follows:

You are required to:

(a) Show whether or not Milo pic should accept the contract and produce liquid E in 1985 and 1986. (5 marks)

(b) Prepare a pro forma income statement which can be used to evaluate the performance of the individual products sold, assuming all liquid processed is sold, in the financial year to 31 July 1985, (i) assuming liquids D and C are sold, (ii) assuming liquids D and E are sold.

Give reasons for the layout adopted and comment on the apportionment of pre-separation costs.

(12 marks)

(c) Calculate, assuming that10000 gallons of liquid C remain unsold at 31 July 1984, and using the FIFO basis for inventory valuation, what would be the valuation of:

(i) the stock of liquid C, and (ii) 10 000 gallons of liquid E after conversion from liquid C.

(4 marks)

(d) Calculate an inventory valuation at replacement cost of 10000 gallons of liquid E in stock at31 July 1985, assuming that the cost of material A is to be increased by 25% from that dale; and comment on the advisability of using replacement cost for inventory valuation purposes in the monthly management accounts. (4 marks)

Note: Ignore taxation

Step by Step Answer: