Advanced: Relevant cash flows and taxation plus a calculation of the weighted average cost of capital Ceely

Question:

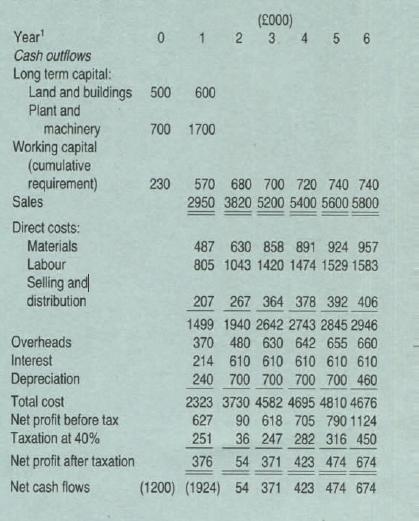

Advanced: Relevant cash flows and taxation plus a calculation of the weighted average cost of capital Ceely pic is evaluating a high risk project in a new industry. The company is temporarily short of accountants, and has asked an unqualified trainee to produce a draft financial evaluation of the project. This draft is shown below:

Cash flows discounted at30% per year (1200) (1480) 32 169 148 124 140 The net present value 1s- £2067000 Cooclus1on The project is not financially viable and should not be undertaken.

Notes:

1 Year 0 is the present time, year 1 one year m the future etc.

Cash flows have been discounted at a high rate because of the high risk of the project.

Assume that you have been engaged as a financial consultant to Ceely pic. The following additional information IS made available to you .

(i) The company has a s1x year planning horizon for capital investments. The value of the investment at the end of SIX years is estimated to be five t1mes the after lax operating cash flows of the sixth year.

(ii) The project would be financed by two 15% debentures, one issued almost immediately and one in a years time.

The debentures would both have a maturity of 10 years.

(iii) 50% of the overheads would be 1ncurred as a direct result of undertaking this project.

(iv) Corporate taxation is at the rate of 40% payable one year 1n arrears.

(v) Tax allowable depreciation IS on a stra1ght-hne basis at a rate of 20~o per year on the full historic cost of depreciable fixed assets. Land and buildings are not depreciable fixed assets and their total value is expected to be £1 .1 million at the end of year six.

(vi) The company is listed on the USM. Its current share price IS 273 pence, and its equity beta coefficient value is 1.1 (vii) The yield on Treasury Bills is 12% per year, and the average total yield from companies forming the Financial Times Actuaries All Share Index is 20% per year.

(vifi) Interest rates are not expected to change Significantly.

(ix) The equity beta value of a company whose major activity is the manufacture of a similar product to that proposed 1n Ceely's new project is 1.5. Both company's have gearing levels of 60% equity and 40% debt (by market values).

Ceely 's gearing includes the new debenture issues.

Required

(a) Modify the draft financial evaluation of the project. where appropriate, to produce a revised estimate of the net present value of the project. Recommend whether the project should be accepted. and briefly discuss any reservations you have about the accuracy of your revised appraisal Slate clearly any assumptions that you make (20 marks)

(b) You are later told that the draft cash flow estimates did not include the effects of changing prices. Discuss whether. on the basis of this new information. any further amendments to your analysis might be necessary .

Step by Step Answer: