Advanced : Safety stocks and uncertain demand and quantity discounts Runswick Ltd is a company that purchases

Question:

Advanced : Safety stocks and uncertain demand and quantity discounts Runswick Ltd is a company that purchases toys from abroad for resale to retail stores. The company is concerned about its stock

(inventory) management operations. It is considering adopting a stock management system based upon the economic order quantity

(EOQ)model.

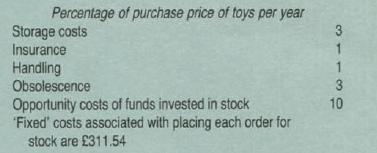

The company's estimates of its stock management costs are shown below·

The purchase price of the toys to Runswick Ltd is £4.50 per unit.

There Is a two week delay between the time that new stock is ordered from suppliers and the time that it arrives.

The toys are sold by Runswick at a unit price of £6.30. The variable cost to Runswick of selling the toys is £0.30 per unit.

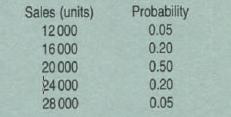

Demand from Runswick · s customers for the toys averages 1 0 000 units per week, but recently th1s has varied from 6000 to 14 000 units per week On the basis of recent evidence the probability of unit sales in any two week penod has been estimated as follows:

If adequate stock is not available when demanded by Runswick's customers in any two week period approximately 25% of orders that cannot be satisfied 1n that period will be lost, and approximately 75% of customers will be willing to wait until new stock arrives.

Required:

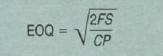

(a) Ignoring taxation, calculate the optimum order level of stock over a one year planning period using the economic order quantity model;

Where: Fis the fixed cost per order.

Sis the annual sales.

Cis the cost of carrying a unit of stock per period expressed as a percentage of its purchase cost Pis the purchase price per unit of stock. (3 marks)

(b) Est1mate the level of safety stock that should be carried by Runswick Ltd. (6 marks)

(c) If Runswick Ltd were to be offered a quantity discount by its suppliers of 1% for orders of 30 000 units or more. evaluate whether it would be beneficial for the company to take advantage of the quantity discount. Assume for this calculation that no safety stock is carried. (4 marks)

(d) Estimate the expected total annual costs of stock management if the economic order quantity had been (i)

50% higher (ii) 50% lower than its actual level. Comment upon the sensitivity of total annual costs to changes in the economic order quantity. Assume for this calculation that no safety stock is carried. (4 marks)

(e) Discuss briefly how the effect of seasonal sales variations might be incorporated within the model. (3 marks)

(f) Assess the practical value of this model in the management of stock.

Step by Step Answer: