Advanced: Single and multi-period capital rationing Schobert Ltd is a retailing company which operates a small chain

Question:

Advanced: Single and multi-period capital rationing Schobert Ltd is a retailing company which operates a small chain of outlets. The company is currently (i.e. December 2000) finalizing its capital budgets for the years to 31 December 2001 and 31 Decem¬ ber 2002. Budgets for existing trading operations have already been prepared and these indicate that the company will have cash available of £250 000 on 1 January 2001 and £150000 on 1 January 2002. This cash will be available for the payment of dividends and/or for the financing of new projects.

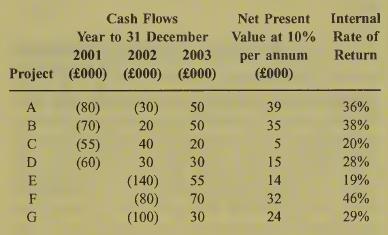

Seven new capital projects are currently being considered by Schobert Ltd. Each is divisible but none is repeatable. Relevant data for each of the investments for the periods to 31 December 2003 are provided below:

The financial director of Schobert Ltd predicts that no new external sources of capital will become available during the period from 1 January 2001 to 31 December 2002, but believes conditions will improve in 2003, when the company would no longer expect capital to be rationed.

The objective of the directors of Schobert Ltd is to maximize the present value of the company’s ordinary shares, assuming that the value of ordi¬ nary shares is determined by the dividend growth model. The company’s cost of capital is 10% per annum, and all cash surpluses can be invested elsewhere to earn 8% per annum. A dividend of at least £100000 is to be paid to 1 January 2000, and the company’s policy is to increase its annual dividend by at least 5% per annum.

Requirements:

(a) Formulate, but do not solve, the company’s capital rationing problem as a linear programme. (8 marks)

(b) Assuming that the results of the linear programme show a dual price of cash in 2001 of £0.25 and 2002 of £0, and a range of cash amounts for which the dual price is relevant of £120000 to £180000, explain their significance to the directors of Schobert Ltd. (7 marks)

(c) Discuss the circumstances under which capital might be rationed, and the problems these present for capital budgeting decisions.

Step by Step Answer: