Advanced: Multi-period capital rationing Alexandra Ltd is a newly established manufactur ing company. The companys only asset

Question:

Advanced: Multi-period capital rationing Alexandra Ltd is a newly established manufactur¬ ing company. The company’s only asset is £5 million in cash from the amount received on the issue of the ordinary shares. This is available for investment immediately. A call on the shares will be made exactly a year from now. This is expected to raise a further 2.5 million which will be available for investment at that time. The directors do not wish to raise finance from any other source and so next year’s (year 1 ’s) investment finance is limited to the cash to be raised from the call plus any cash generated from investments undertaken this year.

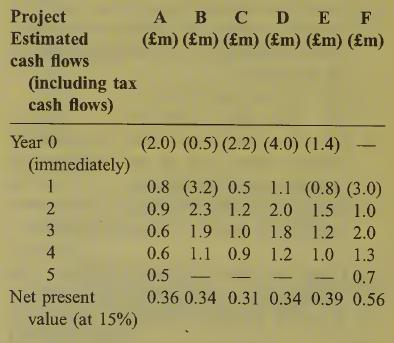

Six possible investment projects have been identified. Each of these involves making the necessary initial investment to establish a manu¬ facturing facility for a different product. Informa¬ tion concerning the projects is as follows:

None of these projects can be brought forward.

delayed or repeated. Each project is infinitely divisible.

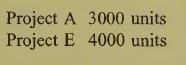

Any funds not used to finance these projects will be invested in the ordinary shares of a rival listed company, expected to generate a 15% return. Generally there is no shortage of labour and materials. Both Project A and Project E, however, require the use of a special component which the company will have to obtain from a far eastern supplier. Because of the relatively short notice, the supply of these will be limited during year 1 to 5000 units.

The estimates in the table (above) are based on a usage of the special component during year 1 as follows:

From year 2 onwards the company will be able to obtain as many of the components as it needs.

The finance director proposes using linear programming to reach a decision on which projects to undertake. The company has access to some Simplex linear programming software, but no one in the company knows how to use it and your advice has been sought.

Requirements:

(a) Prepare the objective function and the various constraint statements which can be used to deduce the optimum investment schedule, giving a brief narrative explanation of each statement and stating any assumptions made. The solution to the linear programming problem is not required. (7 marks)

(b) State the information (not the actual figures)

which the linear programming process will produce in respect of Alexandra Ltd’s alloca¬ tion problem and explain how that informa¬ tion can be used.

Step by Step Answer: