Amex Company is considering the introduction of a new product which will be manufactured in an existing

Question:

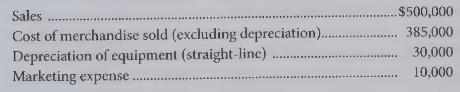

Amex Company is considering the introduction of a new product which will be manufactured in an existing plant; however, new equipment costing \(\$ 150,000\) with a useful life of five years (no salvage value) will be necessary. The space in the existing plant to be used for the new product is currently used for warehousing. When the new product takes over the warehouse space, on which the annual depreciation is \(\$ 20,000\), Amex Company will rent warehouse space at an annual cost of \(\$ 25,000\). An accounting study produces the following estimates on an average annual basis:

Amex requires an accounting rate of return of 11 percent (after income taxes) on average investment proposals. The effective income tax rate is 46 percent. Ignore the time value of money.

{Required:}

(a) Determine the average annual increase in costs (including income taxes) associated with the proposed product.

(b) Determine the minimum annual increase in net income needed to meet the company's requirements for this investment.

Step by Step Answer:

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline