The Morton Company is planning to invest ($ 10,000,000) in an expansion program which is expected to

Question:

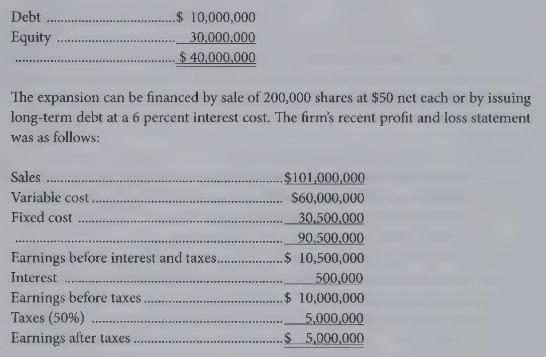

The Morton Company is planning to invest \(\$ 10,000,000\) in an expansion program which is expected to increase earnings before interest and taxes by \(\$ 2,500,000\). The company currently is earning \(\$ 5\) per share on \(1,000,000\) shares of common outstanding. The capital structure prior to the investment is:

{Required:}

Assuming the firm maintains its current earnings and achieves the anticipated earnings from the expansion, what will be the earnings per share if the expansion is financed by

(a) debt?

(b) equity?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Cost Accounting For Managerial Planning Decision Making And Control

ISBN: 9781516551705

6th Edition

Authors: Woody Liao, Andrew Schiff, Stacy Kline

Question Posted: