As a recently appointed assistant management accountant you are attending a monthly performance meeting. You have with

Question:

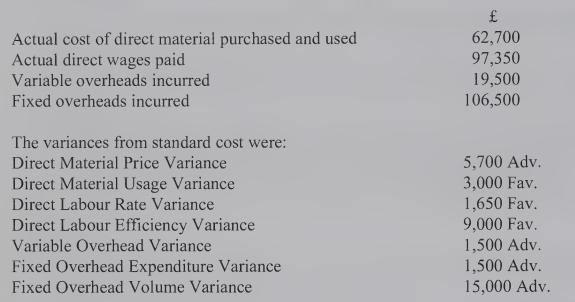

As a recently appointed assistant management accountant you are attending a monthly performance meeting. You have with you a statement of monthly actual costs, a summary of cost variances and other pieces of information you have managed to collect, as shown below;

The actual wage rate paid for the period was £8-85 per hour. It takes three standard hours to produce one unit of the finished product. The single direct material used in the period cost 30p per kg above the standard price. Five kg of raw material input is allowed for as standard for one unit of output.

All figures relate to the single product which is manufactured at the plant. There were no stocks at the beginning or end of the accounting period. Variable and fixed overhead absorption rates are based on standard hours produced. Managers from various functions have brought to the meeting measures which they have collected for their own areas of responsibility. In order to demonstrate the link between the accounting values and their measures you decide to work from the variances to confirm some of them.

Required:

(a) The formula for the calculation of the labour cost variance is: (SH x SR) - (AH x AR)

Provide formulae for the calculation of the labour rate variance and labour efficiency variance using similar notation to that above. Demonstrate how they will sum to the labour cost variance given above. (2 marks)

(b) Using variance formulae, such as those above, or otherwise, determine:

(i) the actual number of direct labour hours worked (ii) the standard rate of pay per direct labour hour (iii) the standard hours of production (iv) the actual production in units (v) the actual quantity of direct material consumed

(vi) the actual price paid for the direct material (per kg)

(vii) the standard direct material usage in kg for the actual number of units produced.

(10 marks)

(c) From

(b) above and any other calculations which may be appropriate, compute the standard cost per unit of finished product. Show separately standard prices and standard quantities for each element of cost. (4 marks)

(d) Briefly interpret the overhead variances given in the question

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780273687511

3rd Edition

Authors: Charles T. Horngren, George Foster, Srikant M. Datar