The Independent Film Company pic is a film distribution company which purchases distribution rights on films from

Question:

The Independent Film Company pic is a film distribution company which purchases distribution rights on films from small independent producers, and sells the films on to cinema chains for national and international screening. In recent years the company has found it difficult to source sufficient films to maintain profitability. In response to the problem, the Independent Film Company has decided to invest in commissioning and producing films in its own right. In order to gain the expertise for this venture, the Independent Film Company is considering purchasing an existing filmmaking concern, at a cost of £400,000.

The main difficulty that is anticipated for the business is the increasing uncertainty as to the potential t success/failure rate of independently produced films. Many cinema chains are adopting a policy of only buying films from large international film companies, as they believe that the market for Independent films is very limited and specialist in nature. The Independent Film Company is prepared for the fact that they are likely to have more films that fail than that succeed, but believe that the proposed film production business will nonetheless be profitable.

Using data collected from the existing distribution business and discussions with industry experts, they have produced cost and revenue forecasts for the five years of operation ofthe proposed investment. The company aims to complete the production ofthree films per year. The after-tax cost of capital for the company is estimated to be 14%.

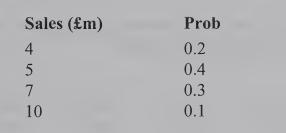

Year 1 sales for the new business are uncertain, but expected to be in the range of £4m-£10m

Probability estimates for different forecast values are as follows:

Sales are expected to grow at an annual rate of 5%.

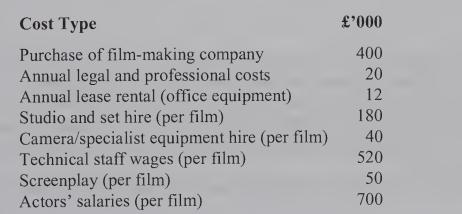

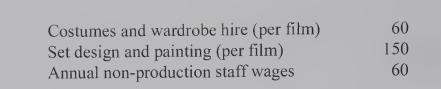

Anticipated costs related to the new business are as follows:

Additional Information (i) No capital allowances are available.

(ii) Tax is payable one year in arrears, at a rate of 33% and full use can be made oftax refunds as they fall due.

(iii) Staff wages (technical and non-production staff) and actors’ salaries, are expected to rise by 10% per annum.

(iv) Studio hire costs will be subject to an increase of 30% in Year 3.

(v) Screenplay costs per film are expected to rise by 15% per annum due to a shortage of skilled writers.

(vi) The new business will occupy office accommodation which has to date been let out for an annual rent of £20,000. Demand for such accommodation is buoyant and the company anticipates no problems in finding future tenants at the same annual rent.

(vii) A market research survey into the potential for the film production business cost £25,000.

Required:

(a) Using DCF analysis, calculate the expected Net Present Value of the proposed investment.

(Workings should be rounded to the nearest £’000.)

(b) Outline the main limitations of using expected values when making investment decisions.

(c) In addition to the possible purchase of the film-making business, the company has two other investment opportunities, the details of which are given below:

Post-Tax Cash Flows, £’000 Year 0 Year I Year 2 Year 3 Year 4 Year 5 Year 6 Investment X (200) 200 200 150 100 100 100 Investment Y (100) 80 80 40 40 40 40 The Independent Film Company has a total of £400,000 available for capital investment in the current year. No project can be invested in more than once Required:

(i) Define the term profitability index, and briefly explain how it may be used when a company faces a problem of capital rationing in any single accounting period.

(ii) Calculate the profitability index for each of the investment projects available to the Independent Film Company, i.e. purchase of the film production company. Investment X and Investment Y, and outline the optimal investment strategy. Assume that all of the projects are indivisible.

(iii) Explain the limitations of using a profitability index in a situation where there is capital rationing

(d) Briefly explain how the tax treatment of capital purchases can affect an investment decision

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780273687511

3rd Edition

Authors: Charles T. Horngren, George Foster, Srikant M. Datar