Comparison of actual costing methods. (20-30 minutes) Haselbach, GmbH, sells its razors at Sch 3 per unit.

Question:

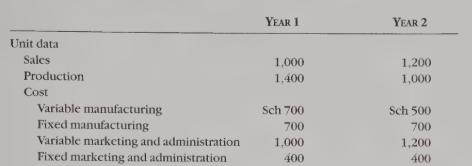

Comparison of actual costing methods. (20-30 minutes) Haselbach, GmbH, sells its razors at Sch 3 per unit. The company uses a first-in, firstout actual-costing system. A new fixed manufacturing overhead alloca- tion rate is calculated each year by dividing the actual fixed manufacturing overhead cost by the actual production units. The following simplified data are related to its first two years of Operation: mki7

REQUIRED 1. Prepare income statements based on

(a) variable costing and

(b) absorption costing for each year.

2. Prepare a reconciliation and explanation of the difference in the operating profit for each year resulting from the use of absorption costing and variable costing.

3. Critics have claimed that a widely used accounting system has led to undesirable stockbuilding levels.

(a) Is variable costing or absorption costing more likely to lead to such buildups? Why?

(b) What can be done to counteract undesirable stock buildups?

Step by Step Answer:

Management And Cost Accounting

ISBN: 9780130805478

1st Edition

Authors: Charles T. Horngren, Alnoor Bhimani, Srikant M. Datar, George Foster