Intermediate: Calculation of actual inputs wo rking bac k from variances (a) Q Umited operates a system

Question:

Intermediate: Calculation of actual inputs wo rking bac k from variances

(a) Q Umited operates a system of standard costing and 1n respect of one of its products wh1ch is manufactured w1thin a single cost centre, the following information is g1ven.

For one unit of product the standard material input is 16 litres at a standard price of £2.50 per litre. The standard wage rate is £5 per hour and 6 hours are allowed in which to produce one unit. Fixed production overhead is absorbed at the rate of 120% of direct wages cost.

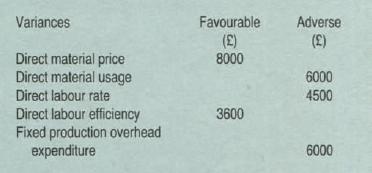

During the last four-week accountmg period The material price variance was extracted on purchase and the actual price pa1d was £2 45 per litre.

Total direct wages cost was £121500.

Fixed production overhead incurred was £150 000.

You are required to calculate for the four-week period (i) budgeted output In units, (ii) number of litres purchased, (iii) number of litres used above standard allowed, (iv) actual units produced, (v) actual hours worked, (vi) average actual wage rate per hour (16 marks)

(b) 'Physical measures of output and technical measures of production efficiency are often more useful than financial measures, particularly at the lower levels of an orgamzation.

You are required, in the context of variance analysis, to discuss and expand on the above statement

Step by Step Answer: