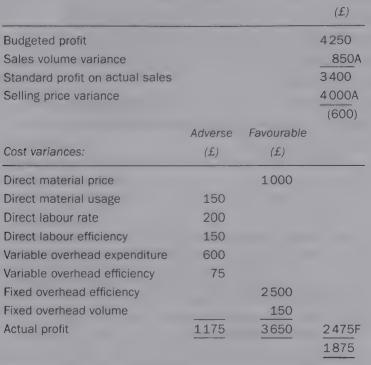

Intermediate: Calculation of actual quantities working backwards from variances. The following profit reconciliation statement summarizes the performance

Question:

Intermediate: Calculation of actual quantities working backwards from variances. The following profit reconciliation statement summarizes the performance of one of SEWs products for March.

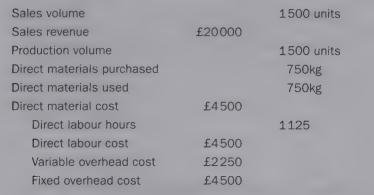

The budget for the same period contained the following data:

Additional information:

e stocks of raw materials and finished goods are valued at standard cost;

e during the month the actual number of units produced was 1550;

e the actual sales revenue was £12000;

e the direct materials purchased were 1000kg.

Required:

(a) Calculate (i) the actual sales volume;

(ii) the actual quantity of materials used;

(ii) the actual direct material cost;

(iv) the actual direct labour hours;

(v) the actual direct labour cost;

(vi) the actual variable overhead cost;

(vii) the actual fixed overhead cost. (19 marks)

(b) Explain the possible causes of the direct materials usage variance, direct labour rate variance and sales volume variance. : (6 marks)

CIMA Operational Cost Accounting Stage 2

Step by Step Answer: